Quick summary

- The fuel and convenience market is shifting from selling gallons to selling services: subscriptions, scheduled top-ups, fleet contracts, and in-app retail.

- On-demand fuel delivery remains a niche market today, but the integration of IoT and supply-chain software creates the platform economics to scale it.

- Startups win by starting with fleets (predictable orders), building robust telemetry for safety, and offering modular SaaS for retailers.

- Profit comes from subscriptions, B2B contracts, and nonfuel retail margins, not just pump price.

- Key risks include compliance, insurance, and the execution of safe operations.

Introduction

The age of fuel and convenience is less about gallons and more about experiences: scheduled top-ups, fleet billing, and forecourts that feel like mini convenience ecosystems. According to market reports, on-demand fuel delivery was a modest market in 2024, but it carries a strong compound growth projection as logistics technology and IoT make doorstep refueling feasible.

That means the obvious headline “deliver petrol to someone’s car” misses the product opportunity. The real prize is recurring revenue and embedded services: fleet contracts, subscription passes, forecourt loyalty, and the analytics that turn inventory into insights. McKinsey argues that forecourt retailers who adopt analytics and AI can offset shrinking fuel margins by boosting nonfuel revenue and charging for services.

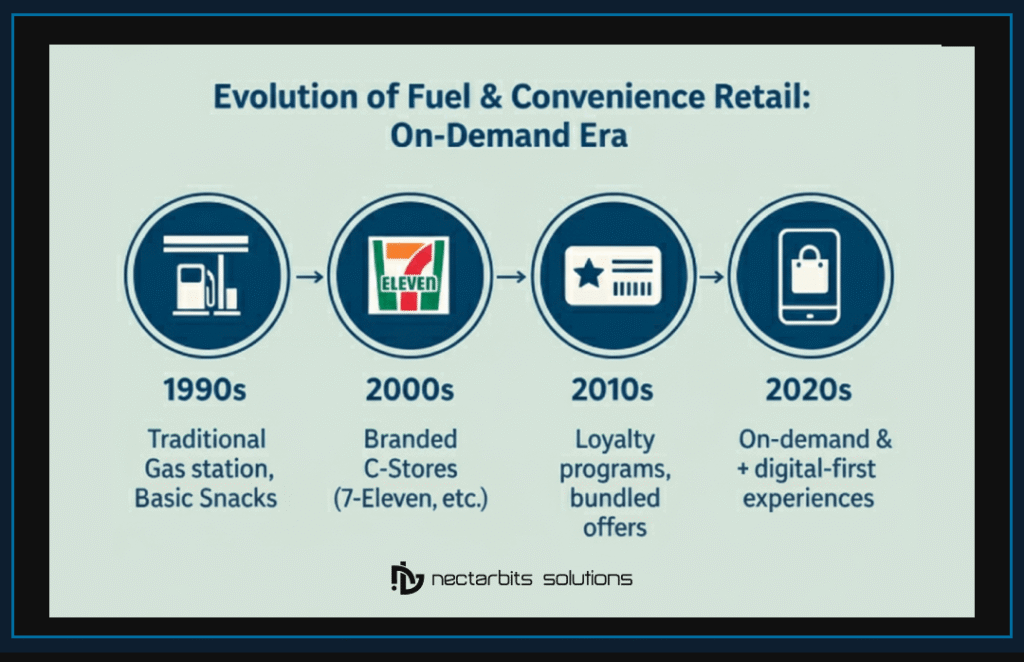

The Evolution of Fuel and Convenience Retail for the On-Demand Era

Across the United States, there are more than 152,000 convenience stores, with about 121,852 of them selling fuel. That means convenience outlets account for roughly 80% of fuel sales among the country’s ~150,000 fueling sites, making them the primary channel for Americans to refuel. The remaining 20% of outlets include kiosks, hypermarkets like Costco and Walmart, and traditional service stations.

Fuel demand in the U.S. is massive, around 9 million barrels per day, equal to nearly 378 million gallons daily. A typical convenience-store site pumps about 4,000 gallons per day, while large hypermarkets can sell up to five times more. Outliers such as Buc-ee’s, with more than 100 fueling positions per site, push daily volumes even higher.

The ownership landscape shows how much small businesses matter. Roughly 55% of fuel-selling stores are single-store operators, many operating under major fuel brand canopies without their own retail branding. Meanwhile, oil giants like Shell, Chevron, and ExxonMobil collectively maintain over 15,000 franchised outlets, balancing a highly fragmented sector with a powerful corporate presence

Understanding the Fuel-as-a-Service Revolution

The concept sounds almost too simple: instead of driving to fuel, fuel drives to you. Yet this straightforward idea masks sophisticated logistics, cutting-edge technology, and complex regulatory navigation that make modern fuel and convenience delivery possible.

Core Components of the Business Model

Fuel-as-a-Service operates on three fundamental pillars:

- On-demand ordering systems – Mobile apps that allow scheduling and immediate requests

- Smart logistics networks – Route optimization algorithms that maximize delivery efficiency

- Flexible pricing models – Subscription tiers, pay-per-gallon, and hybrid approaches

The beauty lies in the simplicity for end users. Open an app, set your location, choose your fuel type, and a certified technician arrives with a mobile fueling truck. No more calculating detours to gas stations or losing productive hours to refueling runs.

Technology Stack Requirements

Building a competitive fuel delivery platform requires more than a basic booking app. According to TechNavio (2023), successful platforms integrate at least seven core technologies:

- GPS tracking for real-time delivery monitoring

- Payment gateways supporting multiple transaction types

- Inventory management systems for fuel tracking

- Route optimization algorithms

- Customer relationship management (CRM) tools

- Compliance tracking modules

- Analytics dashboards for business intelligence

What’s particularly interesting? The rise of IoT integration in fuel industry applications has enabled predictive refueling. Sensors in vehicle fuel tanks can automatically trigger delivery requests when levels drop below predetermined thresholds.

Market Dynamics and Opportunities

Target Customer Segments

While consumer delivery grabs headlines, B2B segments drive the real growth. Fleet operators, construction companies, and agricultural businesses represent 74% of current market volume (Frost & Sullivan, 2024). These customers value predictability and efficiency over marginal cost savings.

Consider construction sites. Every trip to a gas station means:

- Equipment downtime

- Driver wages during transit

- Increased accident risk

- Productivity losses

A fuel delivery solution eliminates these inefficiencies. One delivery can service multiple vehicles simultaneously, turning a two-hour refueling operation into a 20-minute background task.

Revenue Models That Actually Work

Successful fuel delivery startups employ hybrid monetization strategies:

Subscription tiers provide predictable revenue streams. Basic plans might include monthly delivery quotas, while premium tiers offer priority scheduling and volume discounts.

Transaction fees capture value from occasional users. These typically range from $5 to $15 per delivery, depending on volume and distance.

Value-added services boost margins significantly. Oil changes, windshield fluid top-ups, and basic maintenance checks during fuel delivery can increase average transaction values by 35-50% (McKinsey, 2023).

Ever wonder why traditional gas stations make most profits from convenience items rather than fuel itself? Smart fuel delivery startups are learning this lesson, bundling complementary services to improve unit economics.

Technology Infrastructure and Fuel Supply Chain Software

Building vs. Buying Core Systems

Startups face a critical decision: develop proprietary fuel supply chain software or license existing platforms. The build-versus-buy calculation involves multiple factors:

Building custom solutions offers:

- Complete control over features

- Unique competitive advantages

- No recurring licensing fees

- Full data ownership

Licensing platforms provide:

- Faster time-to-market

- Proven reliability

- Regular updates and support

- Lower initial investment

Most successful startups adopt a hybrid approach. They license core infrastructure while building proprietary features for differentiation. The Top Fuel Delivery Apps demonstrate this pattern consistently standard booking flows with unique value propositions layered on top.

IoT and Automation Integration

The real magic happens when physical and digital worlds merge. IoT integration in fuel industry operations transforms reactive businesses into proactive service providers.

Smart fuel tanks equipped with ultrasonic sensors continuously monitor levels. When supplies dip below optimal thresholds, the system automatically:

- Generates delivery requests

- Optimizes routing based on driver availability

- Sends notifications to customers

- Updates inventory databases

- Triggers supplier reorders if needed

This automation reduces operational overhead by approximately 40% while improving customer satisfaction scores by 28% (Gartner, 2024).

Security and Compliance Considerations

Handling hazardous materials requires rigorous safety protocols. Digital platforms must track:

- Driver certifications and training records

- Vehicle inspection schedules

- Delivery documentation for regulatory audits

- Environmental compliance metrics

- Insurance verification status

One overlooked detail can result in substantial fines or operational shutdowns. Robust compliance modules aren’t optional, they’re existential necessities.

Operational Excellence in Fuel and Convenience Delivery

Fleet Management Strategies

Running a fuel delivery service means becoming a logistics company first, energy provider second. Efficient fleet operations determine profitability more than fuel margins.

Key performance indicators include:

- Delivery density – Services per mile driven

- Utilization rates – Active delivery hours versus available hours

- Fuel efficiency – Ironically, crucial for fuel delivery trucks

- Maintenance costs – Preventive versus reactive repair ratios

Leading operators achieve 85%+ fleet utilization through dynamic routing algorithms that continuously reoptimize based on new orders, traffic conditions, and driver availability (Transport Intelligence, 2023).

Safety Protocols and Training

Pumping fuel into vehicles in parking lots requires different safety considerations than traditional gas stations. Comprehensive training programs cover:

Environmental protection, including spill prevention and response procedures. Even minor incidents can trigger significant cleanup costs and reputational damage.

Fire safety protocols specific to mobile fueling operations. This includes proper grounding procedures, static electricity management, and emergency response plans.

Customer interaction standards ensure professional service delivery. Remember, technicians are entering private property and interacting directly with client vehicles.

The Fuelster App Case Study highlights how rigorous safety standards actually become competitive advantages, with zero-incident operators commanding premium pricing.

Customer Acquisition and Retention Strategies

Digital Marketing Approaches

Traditional advertising rarely works for fuel delivery startups. Success comes from targeted digital campaigns focusing on specific pain points.

Search engine optimization targets long-tail keywords like “construction site fuel delivery” or “fleet fueling services near me.” Generic terms prove too competitive for bootstrapped startups.

Content marketing educates potential customers about service benefits. Blog posts, case studies, and cost calculators drive organic traffic while establishing thought leadership.

Partnership marketing leverages existing relationships. Fleet management software providers, construction equipment dealers, and business associations offer direct access to ideal customers.

Building Trust in a Traditional Industry

Fuel represents a significant expense for most businesses. Convincing them to abandon familiar gas station relationships requires substantial trust-building.

Successful strategies include:

- Free trials for qualified businesses

- Transparent pricing with no hidden fees

- Insurance guarantees covering potential vehicle damage

- 24/7 support for emergencies

- Performance SLAs with financial penalties for failures

Social proof accelerates adoption. Video testimonials from satisfied customers carry more weight than any marketing message. Show real fleet managers explaining actual cost savings and operational improvements.

Regulatory Navigation and Compliance

Permits and Licensing Requirements

Operating legally requires multiple authorizations:

Federal permits from the Department of Transportation for hazardous material handling. These involve extensive documentation and regular inspections.

State licenses vary significantly. California requires different certifications than Texas, complicating multi-state expansion plans.

Local permits often prove most challenging. City councils worry about safety implications of mobile fueling in residential areas. Patient education and community engagement become essential.

The PetroApp Business Model demonstrates how proper regulatory preparation enables rapid geographic expansion once initial approvals are secured.

Environmental Regulations

Fuel delivery operates under strict environmental oversight. The Environmental Protection Agency (2024) requires:

- Spill Prevention, Control, and Countermeasure (SPCC) plans

- Underground Storage Tank (UST) compliance for depot facilities

- Air quality permits for vapor recovery systems

- Stormwater management protocols

Non-compliance penalties start at $50,000 per violation and can reach millions for serious infractions. Investing in robust compliance systems isn’t optional it’s survival.

Future Trends Shaping Fuel and Convenience Services

Alternative Fuel Integration

Electric vehicle charging presents both threat and opportunity. While reducing gasoline demand, mobile EV charging services follow similar operational models. Forward-thinking operators are already adding mobile charging capabilities to their fleets.

Hydrogen fuel delivery could become the next frontier. Early pilots in California demonstrate feasibility, though infrastructure limitations currently constrain growth (California Fuel Cell Partnership, 2024).

Artificial Intelligence and Predictive Analytics

Machine learning algorithms increasingly drive operational decisions:

Demand forecasting predicts order volumes based on weather, events, and historical patterns. This enables proactive resource allocation.

Price optimization adjusts rates dynamically based on supply, demand, and competitive factors. Similar to airline pricing but for fuel delivery.

Predictive maintenance identifies vehicle issues before failures occur. Reducing unexpected downtime improves reliability and reduces costs.

Can AI completely automate fuel delivery operations? Perhaps eventually, but human judgment remains crucial for safety-critical decisions and customer service excellence.

Conclusion

The transformation of fuel and convenience into an on-demand service represents more than technological innovation it’s a fundamental reimagining of energy distribution for the digital age. Startups entering this space inherit massive market opportunities, but success demands excellence across technology, operations, and regulatory compliance. Those who master this complex equation will find themselves powering the next generation of mobility services.

FAQ

Q: How much does it cost to start a fuel delivery business?

Initial investments typically range from $250,000 to $1 million depending on scale and geography. Major expenses include delivery vehicles ($75,000-150,000 each), fuel inventory, insurance, permits, and technology platforms. Many startups begin with leased vehicles and third-party fuel supply chain software to reduce upfront costs. According to IBISWorld (2023), successful operators achieve profitability within 18-24 months of launch.

Q: What insurance coverage is required for mobile fueling operations?

Comprehensive coverage includes general liability ($2-5 million), automobile liability ($1-3 million per vehicle), pollution liability ($1-2 million), and excess/umbrella policies ($5-10 million). Annual premiums typically range from $50,000-200,000, depending on fleet size and operational scope. Working with specialized insurers familiar with hazardous material transport proves essential for adequate coverage and reasonable rates.

Q: How do fuel delivery services maintain competitive pricing?

Despite additional delivery costs, many services match or beat gas station prices through several mechanisms. Bulk fuel purchasing provides 5-10% cost advantages. Eliminating real estate expenses saves significant overhead. Corporate customers value time savings over minor price differences—reducing employee downtime often exceeds any delivery premiums. Dynamic routing optimization minimizes per-delivery costs as customer density increases.

Q: What certifications do fuel delivery drivers need?

Drivers require a Commercial Driver’s Licenses (CDL) with hazmat endorsements. Additional certifications include DOT medical cards, OSHA safety training, and company-specific operational procedures. Many operators provide paid training programs lasting 2-4 weeks. Ongoing education requirements include annual recertifications and quarterly safety meetings.

Q: Can residential customers use fuel delivery services?

While technically feasible, residential delivery faces several challenges. Local ordinances often restrict commercial fueling in residential zones. Lower order volumes make unit economics difficult. Insurance requirements increase substantially. However, some operators successfully serve residential customers in rural areas or through premium subscription models targeting luxury vehicle owners.