The PetroApp business model has emerged as a transformative force in the Middle Eastern transportation and logistics sector, fundamentally changing how fleet operators, government agencies, and individual consumers approach fuel management and payments. Since its inception in 2018, the innovative PetroApp business model has positioned itself as Saudi Arabia’s first standalone provider of cashless fuel payment solutions, successfully serving over 500,000 vehicles across four countries and generating projected revenues exceeding SAR 10 billion by 2025. Through advanced NFC technology, strategic partnerships, and comprehensive fleet management solutions, the PetroApp business model demonstrates how digital transformation can create substantial value for all stakeholders in the fuel distribution ecosystem while supporting the Kingdom’s Vision 2030 objectives.

Introduction to the PetroApp Business Model

The PetroApp business model represents a pioneering approach to digital fuel payment platform technology, addressing longstanding inefficiencies in traditional fuel management systems. Founded by Abdulaziz Alsenan in 2018, this innovative platform emerged from the recognition that fleet operators needed better tools to control fuel expenses, prevent fraud, and optimize operational efficiency, much like modern fuel delivery app development solutions that are revolutionizing the industry. The model’s success stems from its ability to integrate cutting-edge technology with practical solutions that deliver immediate, measurable benefits to customers.

At its core, the PetroApp business model transforms the fundamental relationship between fuel stations, fleet operators, and payment systems by eliminating cash transactions and traditional fuel cards. Instead, the platform utilizes PetroApp NFC fuel payments through smart NFC chips installed directly in vehicle windshields, creating a seamless, secure payment ecosystem that provides unprecedented visibility into fuel consumption patterns. This technological foundation enables the platform to deliver up to 35% fuel budget savings for clients while ensuring complete transaction transparency and fraud prevention.

The strategic significance of the PetroApp business model extends beyond immediate cost savings to encompass broader digital transformation objectives aligned with PetroApp Saudi Arabia’s economic diversification goals. By supporting the Kingdom’s Vision 2030 initiative to reduce reliance on cash transactions and modernize government operations, PetroApp has secured strategic partnerships and regulatory backing that provide competitive advantages and access to substantial government contracts.

PetroApp Business Model – Company Overview

The PetroApp business model operates through a comprehensive ecosystem that serves multiple market segments while maintaining operational excellence across four international markets. The company currently manages operations in Saudi Arabia, Egypt, Thailand, and Nigeria, demonstrating the scalability and adaptability of its core digital fuel payment platform across different markets. This comprehensive approach to fuel delivery solution architecture reduces market risk while providing opportunities to leverage successful innovations across different regulatory environments and competitive landscapes.

PetroApp’s corporate structure supports its ambitious growth objectives through strategic partnerships with leading fuel station networks, government agencies, and technology providers. The company maintains relationships with over 5,000 fuel stations across its operating markets, creating the critical mass necessary to ensure convenient access for fleet customers while providing value to station operators through increased customer traffic and reduced cash handling requirements.

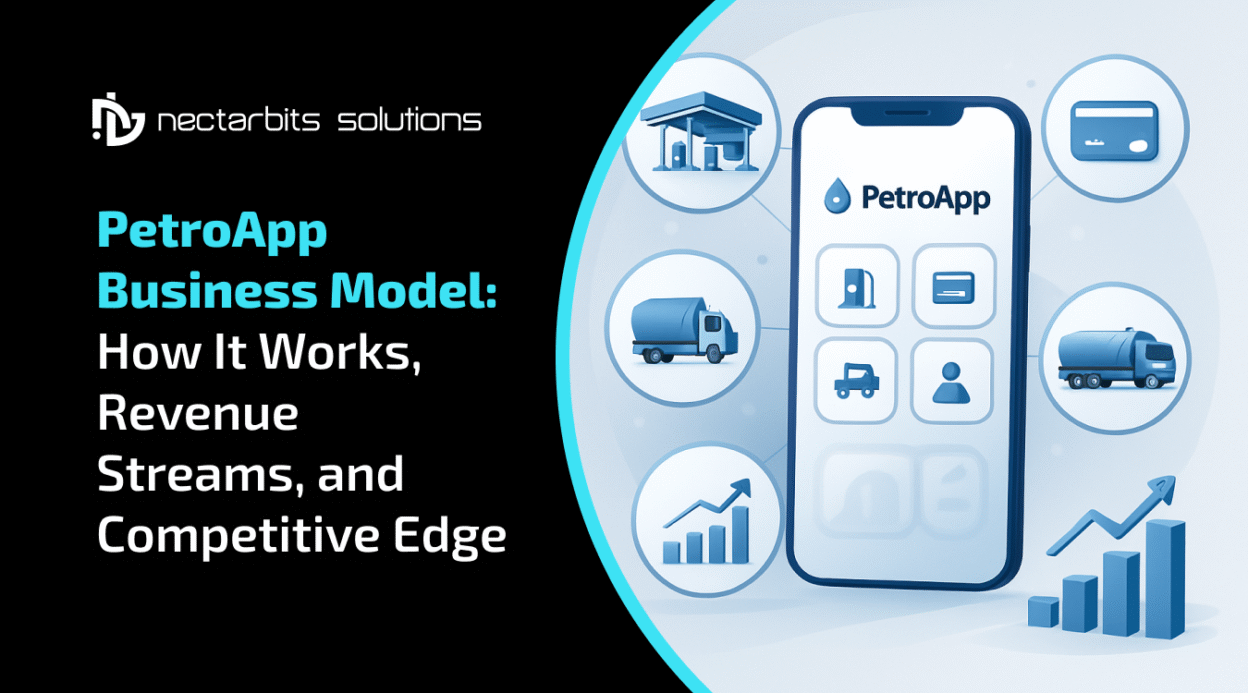

PetroApp’s key performance metrics showcase operational scale and market reach across multiple countries. The company’s recent $50 million funding round by Jadwa Investment demonstrates strong investor confidence in the PetroApp business model and provides capital for accelerated expansion initiatives. This investment round values the company’s market position and growth potential while positioning PetroApp for a planned initial public offering on the Saudi Exchange (Tadawul) by 2028. Financial performance metrics indicate robust growth trajectories consistent with the expanding digital payments market in Saudi Arabia, which is projected to grow from USD 1.16 billion in 2024 to USD 3.86 billion by 2033 at a compound annual growth rate of 14.34%.

PetroApp Business Model – Core Services

The PetroApp business model delivers value through four interconnected service categories that create comprehensive fleet management solutions. PetroApp provides for fuel optimization. Each service component reinforces the others to create strong customer relationships while generating multiple revenue streams that ensure business sustainability and growth potential.

Cashless fuel payments via NFC technology

The foundation of the PetroApp business model rests on advanced Near Field Communication technology that eliminates traditional payment methods while providing superior security and transaction monitoring capabilities. Smart chips installed in vehicle windshields are uniquely linked to specific vehicles and can only be activated when matched with verified identification in the system, ensuring complete transaction security and preventing unauthorized fuel purchases. This PetroApp NFC fuel payments technology creates a tamper-proof payment system that addresses one of the most significant challenges in fleet management: fuel theft and fraud.

The NFC-based infrastructure enables real-time data capture, including fuel volume, location, timestamp, and transaction details, providing fleet managers with unprecedented visibility into fuel consumption patterns. Transaction processing through PetroApp NFC fuel payments occurs instantaneously, reducing wait times at fuel stations while creating detailed audit trails for accounting and compliance purposes.

Fleet monitoring & analytics

Advanced analytics capabilities form a crucial component of the PetroApp business model, enabling clients to make data-driven decisions about fleet operations, maintenance schedules, and resource allocation. The platform’s monitoring systems track comprehensive vehicle performance data, including fuel efficiency, route optimization opportunities, and driver behaviour patterns that impact operational costs. Real-time dashboard interfaces display key performance indicators, including fuel consumption rates, cost per mile calculations, and comparative analysis across different vehicles, drivers, and routes through the digital fuel payment platform.

Additional vehicle services

The PetroApp business model extends beyond fuel management to encompass comprehensive vehicle maintenance and support services that increase customer retention while generating additional revenue streams. Value-added services include car washing, oil changes, tire replacements, battery services, and routine maintenance scheduling, creating a one-stop solution for fleet operators seeking operational simplicity.

ERP integration and real-time dashboards

Seamless integration capabilities ensure that fuel management data flows automatically into existing Enterprise Resource Planning systems without manual intervention, reducing administrative overhead while improving data accuracy. The PetroApp fleet fuel management system supports various ERP platforms commonly used by corporate fleets and government agencies, ensuring compatibility with existing business processes and reporting requirements.

PetroApp Business Model – Target Customers

The PetroApp business model serves three primary customer segments, each with distinct value propositions and service requirements. Corporate fleet operators represent the largest customer segment, encompassing businesses with vehicle fleets ranging from small delivery services to large logistics companies managing hundreds of vehicles. These customers value the cost savings, operational efficiency, and administrative simplification that the PetroApp fleet fuel management system provides through automated fuel management and comprehensive reporting capabilities.

Government agencies constitute a strategically important customer segment due to the size of public sector vehicle fleets and the regulatory advantages that PetroApp enjoys through its EXPRO accreditation. PetroApp government fleet services require specialized compliance reporting, enhanced security features, and integration capabilities with existing procurement and accounting systems. Individual consumers and small fleet operators represent an emerging customer segment that benefits from the platform’s fraud prevention capabilities and simplified fuel expense tracking.

PetroApp Business Model Explained

The operational framework of the PetroApp business model integrates technology, partnerships, and service delivery to create a comprehensive ecosystem that generates value for all participants while building sustainable competitive advantages. This integrated digital fuel payment platform approach differentiates PetroApp from single-point solutions offered by traditional fuel card providers or standalone fleet management companies.

The model’s value creation mechanism centers on network effects that increase platform utility as more participants join the ecosystem. As additional fuel stations integrate with the platform, convenience and accessibility improve for fleet customers, making the service more valuable and reducing switching costs. Transaction processing represents the core operational component, with each fuel purchase generating data that supports optimization recommendations while creating commission revenue.

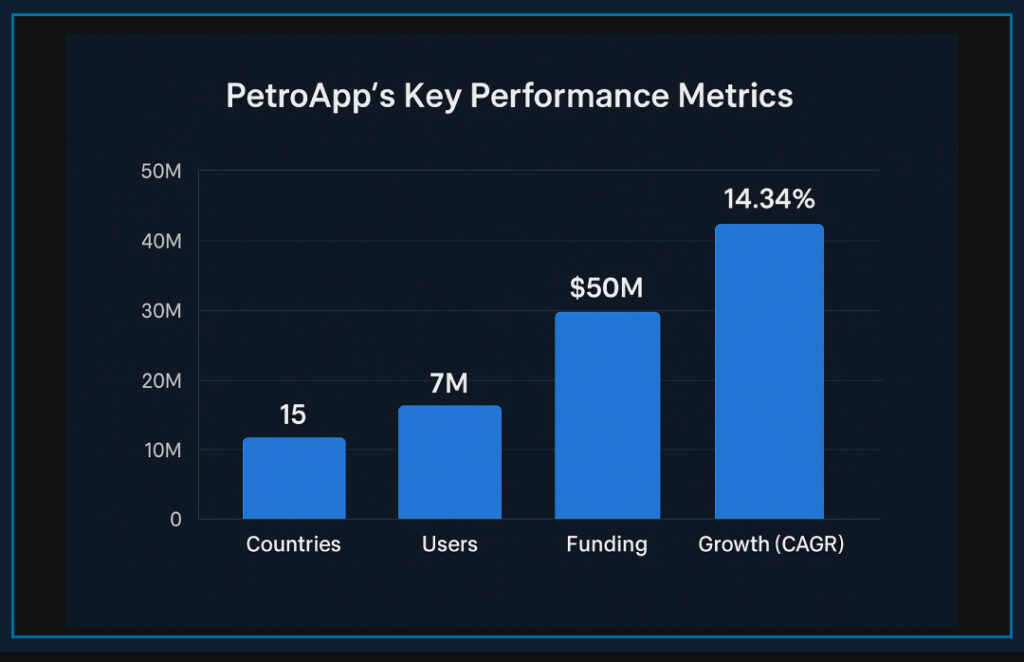

Market growth projections show the expanding opportunities in PetroApp’s key operating sectors. Customer onboarding processes reflect the PetroApp business model’s emphasis on service quality and operational efficiency, with dedicated support teams managing smart chip installation, system integration, and user training. This comprehensive onboarding ensures customer satisfaction while building relationships that support long-term retention and service expansion opportunities.

PetroApp Business Model – Revenue Streams

The diversified revenue structure of the PetroApp business model ensures financial stability while providing multiple avenues for growth and service expansion. Subscription fees represent the primary revenue component, with monthly plans ranging from 9 SAR to 109 SAR depending on fleet size and service requirements. This recurring revenue model provides predictable cash flows that support operational planning and technology development investments while ensuring consistent customer engagement.

Transaction-based commissions create revenue streams that scale with customer usage, aligning PetroApp’s financial success with client satisfaction and platform utilization. Hardware revenue from smart chip sales and installation services represents a significant one-time revenue opportunity for each new customer relationship. Value-added services, including vehicle maintenance, car washing, and emergency roadside assistance, create additional revenue opportunities while increasing customer retention through comprehensive service delivery.

Competitive Advantages of the PetroApp Business Model

The PetroApp business model maintains significant competitive advantages through first-mover positioning, technological leadership, and strategic partnerships that create barriers to entry while supporting continued market share expansion. As PetroApp, Saudi Arabia’s first standalone digital fuel payment provider, PetroApp enjoys substantial first-mover advantages, including brand recognition, established customer relationships, and regulatory approvals that new competitors must invest significant resources to match.

Technological superiority through advanced PetroApp NFC fuel payments and smart chip security provides operational advantages that differentiate PetroApp from traditional fuel card systems and emerging digital payment solutions. Government support through EXPRO accreditation and Vision 2030 alignment provides exclusive access to PetroApp government fleet services contracts while ensuring regulatory support for platform expansion and service development. Network effects create self-reinforcing competitive advantages as platform adoption increases value for all participants while raising barriers to entry for potential competitors.

Technology Behind the PetroApp Business Model

The technological infrastructure supporting the PetroApp business model combines advanced hardware, cloud-based software platforms, and data analytics capabilities to deliver secure, scalable, and reliable service delivery across multiple geographic markets. NFC-enabled smart chips represent the core hardware component, providing secure payment processing while capturing detailed transaction data that supports optimization and fraud prevention.

Cloud-based platform architecture ensures scalability to accommodate rapid customer growth and geographic expansion without requiring significant infrastructure investments. Advanced analytics and machine learning capabilities process vast amounts of transaction and operational data to identify optimization opportunities, predict maintenance requirements, and detect potential fraud or security threats. Mobile application interfaces provide user-friendly access to platform functionality while ensuring that drivers, fleet managers, and administrators can access appropriate information and controls from any location.

PetroApp Business Model – Growth Strategy & Expansion Plans

The expansion strategy underlying the PetroApp business model focuses on geographic diversification, market penetration, and service innovation to capture opportunities in the rapidly growing global fleet management market, which is projected to reach USD 153.3 billion by 2035. International expansion represents a primary growth driver, with successful operations in Egypt, Thailand, and Nigeria demonstrating the adaptability of the fleet management solutions PetroApp provides across different regulatory environments and market conditions.

Technology development initiatives focus on artificial intelligence integration, Internet of Things connectivity, and blockchain security enhancements that will differentiate the digital fuel payment platform from competitors while creating new value propositions for customers. These innovations align with broader trends in fuel delivery technology that are shaping the future of energy distribution and logistics. Strategic partnerships with international fuel retailers, technology companies, and government agencies create opportunities for rapid market entry while reducing investment requirements and regulatory risks. The planned initial public offering by 2028 provides capital for accelerated expansion while creating liquidity opportunities for early investors.

Challenges & Risks in the PetroApp Business Model

Despite its market leadership position, the PetroApp business model faces significant operational, technological, and market risks that could impact growth trajectories and competitive positioning if not properly managed. Cybersecurity threats pose substantial risks to digital payment platforms, with fraud and security breaches potentially damaging customer trust while creating financial liability and regulatory compliance issues.

Technology dependence creates operational vulnerabilities, as system failures, network outages, or software issues could disrupt service delivery across the entire customer base. Regulatory compliance challenges increase as the PetroApp business model expands into new geographic markets with different legal requirements, data protection standards, and financial services regulations. Competitive pressure from established fuel card providers, emerging fintech companies, and international digital payment platforms could erode market share while creating pressure on pricing and service differentiation.

Future Outlook of the PetroApp Business Model

The long-term prospects for the PetroApp business model remain highly favourable due to structural trends supporting digital payment adoption, increasing focus on operational efficiency, and growing demand for comprehensive fleet management solutions that PetroApp offers across global markets. Market expansion opportunities are substantial, with the global fleet management market projected to grow at a 16.9% CAGR through 2035.

Technology evolution presents both opportunities and challenges, as advances in artificial intelligence, blockchain security, and IoT connectivity create possibilities for enhanced service delivery while requiring continued investment in platform development. Environmental sustainability trends support demand for optimization solutions that reduce fuel consumption and emissions while providing detailed monitoring and reporting capabilities. Financial performance projections indicate continued strong growth supported by recurring revenue streams, expanding customer base, and increasing average revenue per user through service diversification.

Conclusion – Why the PetroApp Business Model Matters

The PetroApp business model represents a transformative approach to fleet management and digital payments that demonstrates how innovative technology applications can create substantial value for multiple stakeholders while addressing longstanding industry inefficiencies. The platform’s success in achieving market leadership within PetroApp Saudi Arabia while expanding internationally validates the scalability and adaptability of its core value propositions across different market environments and regulatory frameworks.

The strategic importance of the PetroApp business model extends beyond immediate financial returns to encompass broader implications for digital transformation in traditional industries. The platform’s alignment with Saudi Arabia’s Vision 2030 objectives illustrates how private sector innovation can support national development priorities while creating sustainable business advantages through PetroApp government fleet services and digital fuel payment platform solutions. Looking forward, the PetroApp business model is positioned to capture substantial opportunities within rapidly expanding global markets for digital payments and fleet management solutions, with projected revenues exceeding SAR 10 billion and plans for public listing by 2028.

Frequently Asked Questions

1. What is the PetroApp business model?

The PetroApp business model is a digital fuel payment and fleet management solution designed to streamline fuel transactions for individuals, businesses, and government fleets, primarily in Saudi Arabia.

2. How does PetroApp generate revenue?

PetroApp earns through transaction fees, subscription plans for fleet management, partnerships with fuel stations, and value-added services like NFC-based payments.

3. What technology powers PetroApp’s platform?

PetroApp uses mobile apps, NFC technology, secure payment gateways, GPS tracking, and analytics dashboards to deliver seamless fuel payment and fleet monitoring services.

4. Who can benefit from using PetroApp?

PetroApp serves private vehicle owners, logistics companies, corporate fleets, and government transport departments seeking efficient fuel payment and tracking solutions.

5. How can I build an app like PetroApp?

You can build a PetroApp-like app by partnering with an experienced on-demand fuel delivery app development company offering custom features, security, and scalability.