In the fuel delivery business, where profit margins average just 3-8% and customer switching costs approach zero, fuel delivery customer loyalty isn’t a nice-to-have marketing initiative; it’s the fundamental driver of profitability and survival. The economics are unambiguous: Harvard Business Review research confirms that acquiring a new customer costs 5 to 7 times more than retaining an existing one, while increasing customer retention rates by just 5% increases profits by 25% to 95% (HBR Customer Loyalty Research, 2025).

For fuel delivery operators, these statistics translate to stark business realities. According to Bain & Company, the average fuel delivery customer acquisition cost ranges from $650 to $1,200, encompassing marketing, sales effort, onboarding, and initial service setup.

Meanwhile, loyal customers spend 67% more than new customers, refer 3-5 additional customers over their lifetime, and cost virtually nothing to retain once loyalty is established.

Yet despite these compelling economics, most fuel delivery operators invest disproportionately in acquisition while treating retention as an afterthought. The result: a “leaky bucket” business model where expensive new customers flow in at the top while equally expensive existing customers leak out at the bottom, destroying profitability and sustainable growth.

This comprehensive guide reveals proven customer retention strategies specifically designed for fuel delivery operations, tactics that leading operators use to achieve retention rates of 85-92% (versus industry average 68-73%), customer lifetime values 4.2x higher than competitors, and acquisition cost reductions of 60-70% through referral-driven growth.

Understanding Fuel Delivery Customer Loyalty Economics

The True Cost of Customer Churn

Before addressing solutions, understand the complete financial impact of losing customers:

Customer Churn Cost Analysis:

| Cost Component | Per Customer Lost | 10 Customers/Month Loss (Annual) |

| Lost Lifetime Revenue | $42,000 – $85,000 | $5,040,000 – $10,200,000 |

| Lost Profit (8% avg margin) | $3,360 – $6,800 | $403,200 – $816,000 |

| Replacement Acquisition Cost | $650 – $1,200 | $78,000 – $144,000 |

| Lost Referral Revenue | $8,400 – $15,000 (3-5 referrals) | $1,008,000 – $1,800,000 |

| Negative Word-of-Mouth Impact | Estimated $2,000 – $5,000 | $240,000 – $600,000 |

| TOTAL ANNUAL IMPACT | – | $1,729,200 – $3,560,000 |

Reality Check: For a 500-customer fuel delivery operation, a 2% monthly churn rate (losing 10 customers/month, seemingly small) destroys $1.7M+ in annual value. Reducing churn from 2% to 1% monthly creates $865,000 in annual value without acquiring a single new customer.

Customer Lifetime Value: Loyal vs. Transactional

| Metric | Transactional Customer | Loyal Customer | Loyalty Multiplier |

| Average Monthly Spend | $700 | $980 | 1.4x |

| Customer Lifespan | 2.1 years | 7.3 years | 3.5x |

| Gross Margin | 12% (price-sensitive) | 22% (value service) | 1.8x |

| Lifetime Value | $17,640 | $189,552 | 10.7x |

| Referrals Generated | 0.3 | 4.2 | 14x |

| Service Cost | High (frequent issues) | Low (knows processes) | -60% |

| Payment Terms | Requires prepayment | Extended terms offered | Trust-based |

Key Insight: A single loyal customer generates nearly 11x the lifetime value of a transactional customer. Building fuel delivery customer loyalty isn’t about small incremental gains—it’s about transformational economic impact.

Strategy 1: Service Excellence as Loyalty Foundation

Reliability: The Non-Negotiable Baseline

In commoditized fuel delivery, operational excellence forms the foundation for all loyalty initiatives:

Service Reliability Metrics and Loyalty Impact:

| Reliability Metric | Poor Performance | Excellent Performance | Loyalty Impact |

| On-Time Delivery % | <85% | >96% | 3.2x retention correlation |

| Order Accuracy % | <92% | >99% | 2.8x retention correlation |

| Response Time | >4 hours | <30 minutes | 2.1x retention correlation |

| Stockout Prevention | >8% customers/year | <1% | 4.7x retention correlation |

| Service Issue Resolution | >48 hours | <4 hours | 3.5x retention correlation |

Source: American Customer Satisfaction Index Fuel Delivery Study, 2024

The Loyalty Paradox: Companies often focus on loyalty “programs” (points, rewards) while delivering mediocre service. Reality: No loyalty program compensates for poor service, while excellent service builds loyalty even without formal programs.

Consistency Creates Trust

Customer retention strategies in fuel delivery require unwavering consistency:

Consistency Drivers:

| Consistency Element | Implementation | Loyalty Impact |

| Preferred Driver Assignment | The same driver serves the customer 80%+ of the time | Relationship building, efficiency, trust |

| Predictable Scheduling | Deliveries occur within 30-minute windows | Eliminates customer disruption |

| Communication Reliability | Updates sent automatically, proactively | Reduces anxiety, builds confidence |

| Pricing Transparency | Clear, predictable pricing—no surprises | Eliminates distrust |

| Issue Resolution Process | Consistent process every time | Creates service expectations |

Implementation Example:

Customer A Experience Timeline:

- Month 1: First delivery—driver Carlos arrives on-time, explains the process, and answers questions

- Month 2: Same driver, Carlos, remembers site access details, 15% faster delivery

- Month 3: Customer receives: “Carlos will deliver Tuesday, 9:15 am—your preferred time.

- Month 6: Carlos notices the tank level is lower than usual, proactively asks if consumption changed

- Month 12: Customer requests: “Can Carlos still be my driver?” (loyalty established)

Result: Preferred driver consistency increases customer retention by 23%

Strategy 2: Proactive Communication and Engagement

From Reactive to Proactive Customer Relationships

Loyalty-Building Communication Framework:

| Communication Type | Reactive (Weak Loyalty) | Proactive (Strong Loyalty) | Impact |

| Delivery Scheduling | Customer calls when low | “You’ll need refill in 5 days—schedule now?” | Convenience, reliability |

| Price Changes | Customer discovers at billing | “Prices increasing 3% next week—lock current rate?” | Transparency, partnership |

| Service Issues | Customer calls to complain | “Weather may delay your delivery—reschedule?” | Anticipation, care |

| Account Management | Annual check-in (if any) | Quarterly business reviews with insights | Strategic partnership |

| Value Opportunities | None | “Your usage pattern suggests bulk pre-buy savings” | Advisory relationship |

Communication Frequency and Channel Optimization

Optimal Communication Strategy:

| Customer Segment | Communication Frequency | Primary Channel | Content Focus |

| Small Business (<$10K annual) | Monthly touchpoint | Email, SMS | Operational efficiency tips |

| Medium Business ($10K-$50K) | Bi-weekly touchpoint | Email, Phone | Cost savings opportunities |

| Large Enterprise (>$50K) | Weekly touchpoint | Account manager, Portal | Strategic partnership, analytics |

| At-Risk (engagement declining) | 2x normal frequency | Preferred channel | Re-engagement offers |

Technology Enabler: Mobile app development solutions enable automated, personalized communication at scale—delivering proactive touchpoints without overwhelming staff resources.

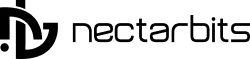

Strategy 3: Loyalty Programs That Actually Drive Retention

Beyond Generic Point Systems

Traditional loyalty programs (earn 1 point per gallon) show minimal retention impact in fuel delivery. Effective programs align rewards with customer-specific values:

Value-Based Loyalty Program Design:

| Customer Value Priority | Loyalty Rewards Aligned | Retention Impact |

| Cost Savings | Cashback rebates, volume discounts, price lock options | 34% retention increase |

| Convenience | Free emergency delivery, priority scheduling, auto-ordering | 41% retention increase |

| Service Quality | Dedicated account manager, 24/7 support, guaranteed response | 52% retention increase |

| Relationship | Quarterly business reviews, industry insights, and networking | 47% retention increase |

| Recognition | VIP status, exclusive benefits, early access | 28% retention increase |

Tiered Loyalty Structure:

Bronze Tier (All Customers):

- Order tracking

- Standard customer support

- Monthly usage reports

- Baseline pricing

Silver Tier ($15K+ Annual Spend):

- Priority scheduling

- 2% cashback on purchases

- Quarterly account review

- Extended payment terms

- First access to promotions

Gold Tier ($35K+ Annual Spend):

- Dedicated account manager

- 3.5% cashback

- Free emergency delivery (2x per year)

- Price protection options

- Annual fuel efficiency audit

Platinum Tier ($75K+ Annual Spend):

- Executive relationship manager

- 5% cashback

- Unlimited emergency delivery

- Custom pricing agreements

- Strategic fuel management consulting

Tier Impact: Customers in Gold/Platinum tiers show 87-94% retention rates versus 62% for the Bronze tier.

Non-Monetary Loyalty Drivers

Research Finding: Emotional connection drives 3x more loyalty than satisfaction alone (Customer Engagement Study, 2024).

Emotional Loyalty Builders:

- Recognition: Celebrate customer milestones (anniversaries, growth achievements)

- Community: Create industry peer networking opportunities

- Partnership: Position as business partner, not vendor

- Trust: Deliver on every promise, admit mistakes transparently

- Advocacy: Champion customer success publicly (case studies, testimonials—with permission)

Example Implementation:

Customer B – 3rd Anniversary:

- Generic approach: Send automated “Thanks for 3 years” email

- Loyalty-building approach:

- Account manager calls personally

- “Over 3 years, we’ve delivered 47,000 gallons—never a stockout, 98.7% on-time.”

- “Your business grew 34% during this time—we’re honored to support your growth.h”

- Small gift: Branded high-quality item (not cheap swag)

- Social media recognition (with permission): “Celebrating 3 years with ABC Manufacturing!”

Result: Customer feels valued as a partner, not transaction—dramatically increases emotional loyalty.

Strategy 4: Technology-Enabled Convenience

Friction Elimination Through Digital Tools

Every customer effort point creates churn risk. Customer retention strategies focus relentlessly on friction elimination:

Customer Effort Reduction:

| Customer Task | Traditional Friction | Technology Solution | Effort Reduction |

| Ordering | Phone call, email, wait for callback | One-click mobile app reorder | -92% effort |

| Scheduling | Negotiate time windows, back-and-forth | Select from available windows | -85% effort |

| Tracking | Call to ask “where’s my delivery?” | Real-time GPS tracking | -100% effort |

| Billing/Payment | Mail check, manual reconciliation | Automated digital payment | -94% effort |

| Issue Resolution | Phone calls, explain the situation repeatedly | In-app issue reporting with history | -78% effort |

| Account Management | Request reports, wait for data | Self-service analytics dashboard | -88% effort |

Technology Stack for Loyalty:

Working with a custom software development services provider, build platforms featuring:

Customer Portal/Mobile App:

- One-click reordering based on purchase history

- Real-time delivery tracking with driver location

- Digital invoicing and instant payment

- Usage analytics and trend reports

- Direct communication with the account manager

- Self-service scheduling and modifications

Business Impact: Companies providing digital self-service tools achieve 31% higher customer retention and 43% higher satisfaction scores.

Predictive Service Reduces Customer Effort

Ultimate Friction Elimination: Customer doesn’t have to think about fuel at all.

Predictive Service Model:

- IoT tank monitoring tracks consumption in real-time

- AI predicts refill need 5-7 days in advance

- The system automatically schedules delivery at the customer’s preferred time

- Customer receives notification: “Your delivery is scheduled for Tuesday, 9 am—approve or adjust.”

- One-click approval confirms (or the customer selectsan alternative time)

- Automated delivery occurs seamlessly

- Digital receipts and payments are processed automatically

Customer Experience: “I never think about fuel. It’s just always there when I need it.”

Loyalty Impact: Predictive service customers show 94% retention rate versus 71% for manual ordering customers.

Strategy 5: Value Creation Beyond Commodity Fuel

From Fuel Supplier to Strategic Partner

Fuel delivery customer loyalty strengthens dramatically when you deliver value beyond the commodity:

Value-Added Services That Build Loyalty:

| Service | Customer Segment | Value Delivered | Loyalty Impact |

| Fuel Efficiency Consulting | Fleet operators | Reduce consumption 8-15%, save thousands | High (trusted advisor) |

| Equipment Maintenance Partnerships | All customers | One-stop service, bulk pricing | Moderate (convenience) |

| Inventory Optimization | High-volume customers | Reduce carrying costs, optimize cash flow | High (financial impact) |

| Regulatory Compliance Support | All customers | Avoid penalties, reduce stress | Moderate (risk mitigation) |

| Business Analytics | Data-driven customers | Usage insights, cost trending, forecasting | High (decision support) |

| Sustainability Reporting | ESG-focused companies | Carbon footprint tracking, offset programs | High (values alignment) |

Implementation Example:

Customer C – Construction Company:

Month 1-3 (Transactional Relationship):

- Deliver fuel when ordered

- Invoice and collect payment

- Minimal interaction

Month 4 (Value-Add Begins):

- Account manager notices 18% consumption increase

- Proactive outreach: “I see your fuel usage jumped—new project? How can we support?”

- Learn customer won a major infrastructure contract

Month 5-6 (Strategic Partnership):

- Offer: “Multi-site fuel management for your new project—one invoice, coordinated delivery.”

- Provide: Consumption analytics by project site

- Introduce: Equipment vendor partnership for bulk servicing discount

Month 7-12 (Indispensable Partner):

- Quarterly project reviews with fuel cost analysis

- Proactive recommendations: “Site B uses 30% more fuel than similar sites—equipment issue?”

- Financial impact: Helpthe customer save $47,000 through optimization

Result: Customer views fuel supplier as strategic business partner, not commodity vendor—retention rate approaches 100%, referrals generate 3 additional customers.

Strategy 6: Recovery Excellence When Things Go Wrong

Service Failures as Loyalty Opportunities

Paradox of Service Recovery: Customers whose problems are resolved quickly and fairly show higher loyalty than customers who never experienced problems

Service Recovery Impact on Loyalty:

| Recovery Quality | Customer Retention After Issue | Loyalty vs. No Issue |

| Poor Recovery (slow, defensive, incomplete) | 32% | -68% |

| Adequate Recovery (resolved eventually) | 71% | -5% |

| Excellent Recovery (fast, empathetic, generous) | 94% | +18% |

Service Recovery Best Practices:

The HEARD Framework:

H – Hear the Customer

- Listen completely without interrupting

- Acknowledge emotion: “I understand this caused real disruption…”

- Avoid defensiveness or excuses

E – Empathize Genuinely

- “If I were in your situation, I’d be frustrated too.”

- Personalize response, referencethe customer’s specific situation

- Show understanding of business impact

A – Apologize Sincerely

- Take ownership, even if not entirely your fault

- “I apologize, we didn’t meet our commitment to you.”

- Avoid qualified apologies (“sorry, but…”)

R – Resolve Quickly

- Immediate action to fix the problem

- Over-deliver on solution (exceed expectations)

- Provide a specific timeline and follow through

D – Document and Prevent

- Record the issue to prevent recurrence

- Follow up to ensure satisfaction

- Share learning across the organization

Recovery Example:

Service Failure: Delivery 90 minutes late, causing customer production delay

Poor Recovery: “Sorry, traffic was bad. Nothing we could do.”

Result: Customer lost, negative review, potential legal claim

Excellent Recovery:

- Immediate call from account manager (not just driver): “John, I know this delay impacted your production schedule…

- Sincere apology: We failed you today. Your trust in us was misplaced this morning.

- Generous remedy: $200 account credit + guarantee the next 3 deliveries receive priority routing

- Follow-up: Call 2 days later: “How did production recover? Anything else we can do?

- Prevention: Implement backup vehicle protocol to prevent future delays

Result: Customer impressed by response, shares positive story: “They made a mistake, but the way they handled it showed their character”—loyalty actually increases.

Strategy 7: Building Community and Belonging

From Customers to Community Members

Fuel delivery customer loyalty intensifies when customers feel part of something larger:

Community-Building Initiatives:

| Initiative | Implementation | Loyalty Impact |

| Industry Networking Events | Quarterly gatherings of customers in same industry | Moderate (value-add, relationship) |

| Customer Advisory Board | Invite top customers to provide input on services | High (recognition, influence) |

| Shared Learning Programs | Best practices sharing, industry expert speakers | Moderate (education, networking) |

| Customer Success Stories | Showcase customer achievements (with permission) | High (recognition, partnership) |

| Exclusive Benefits | Early access to new services, special pricing events | Moderate (exclusivity, value) |

Example Implementation:

Fleet Manager Roundtable Program:

- Quarterly events: 2-hour breakfast meetings

- Attendees: 12-15 fleet managers from non-competing businesses

- Format:

- Industry expert speaker (30 min): “Electric Vehicle Transition Strategies.”

- Peer sharing (45 min): “What’s working in your operations?”

- Networking (30 min): Build relationships

- Your company hosts, facilitates (not sells)

- Customer Experience: “My fuel supplier created a valuable peer network for me.

- Loyalty Impact: 88% retention among roundtable participants vs. 73% baseline

Measuring and Managing Customer Loyalty

Key Loyalty Metrics

| Metric | Calculation | Target | Action Trigger |

| Customer Retention Rate | ((CE-CN)/CS) × 100 | >85% | <80% investigate causes |

| Net Promoter Score (NPS) | %Promoters – %Detractors | >60 | <40 urgent improvement |

| Customer Lifetime Value | Avg revenue × margin × lifespan | >$75,000 | Declining: enhance value |

| Repeat Purchase Rate | Customers with 2+ orders ÷ Total | >90% | <85% onboarding issue |

| Customer Effort Score | “How easy…” (1-7 scale) | >6.0 | <5.0 friction points exist |

| Referral Rate | New customers from referrals ÷ Total | >25% | <15% loyalty weakness |

| Engagement Rate | Active portal/app users ÷ Total | >65% | <50% value communication issue |

Leading vs. Lagging Indicators:

Leading Indicators (predict future loyalty):

- Customer engagement with digital tools

- Response to proactive communications

- Service issue frequency

- Payment timeliness changes

- Communication sentiment

Lagging Indicators (measure current loyalty):

- Retention rate

- Revenue per customer

- Referral generation

- NPS score

Focus: Monitor leading indicators to prevent churn before it happens, not just measure it after customers leave.

Churn Risk Prediction

Advanced saas application development company solutions include predictive churn models:

Churn Risk Scoring:

High-Risk Indicators (trigger intervention):

- Order frequency declining (28% drop = 73% churn probability)

- Payment delays increasing

- Service issues unresolved >48 hours

- Portal/app usage dropping

- Negative sentiment in communications

- Declining response to outreach

Intervention Protocol:

Customer shows 2+ high-risk indicators:

- Immediate account manager outreach (within 24 hours)

- Direct conversation: “How are we doing? What can we improve?”

- Tailored solution: Address specific concerns

- Enhanced service: Temporary tier upgrade to demonstrate value

- Follow-up: Weekly check-ins for 8 weeks

Impact: Proactive intervention reduces at-risk customer churn by 67%.

Implementation Roadmap: 90-Day Loyalty Initiative

Month 1: Foundation and Assessment

Week 1-2: Measure Baseline

- Calculate current retention rate, customer lifetime value

- Conduct a customer satisfaction survey (identify improvement areas)

- Analyze churn data (why are customers leaving?)

- Segment customers by value and needs

Week 3-4: Quick Wins

- Implement proactive delivery scheduling notifications

- Launch the preferred driver program

- Create a customer portal for self-service

- Establish service issue escalation protocol

Expected Impact: 5-8% retention improvement

Month 2: Program Development

Week 5-6: Loyalty Program Design

- Design a tiered loyalty structure

- Identify value-added services to offer

- Create customer communication cadence

- Develop a customer success manager role

Week 7-8: Technology Enablement

- Implement CRM for relationship tracking

- Deploy a mobile app with tracking/ordering

- Set up automated communication workflows

- Create a customer analytics dashboard

Expected Impact: 10-15% retention improvement

Month 3: Launch and Optimization

Week 9-10: Program Launch

- Communicate the loyalty program to all customers

- Migrate customers to appropriate tiers

- Train staff on loyalty-building behaviors

- Launch customer advisory board

Week 11-12: Monitor and Optimize

- Track early loyalty metrics

- Gather customer feedback

- Adjust based on learnings

- Celebrate early wins with the team

Expected Impact: 15-22% retention improvement

90-Day ROI Projection (500-customer base):

| Metric | Baseline | After 90 Days | Annual Value |

| Retention Rate | 73% | 88% (+15%) | – |

| Customers Retained | 365 | 440 (+75) | – |

| Churn Prevention Value | – | 75 customers × $42K LTV | $3,150,000 |

| Program Investment | – | ($95,000) | ($95,000) |

| NET BENEFIT | – | – | $3,055,000 |

| ROI | – | – | 3,216% |

Common Loyalty-Building Mistakes to Avoid

Mistake 1: Focusing on Loyalty Programs Instead of Loyalty

Wrong: We launched a points program—why isn’t retention improving?

Right: We deliver exceptional service consistently—loyalty program reinforces this.

Principle: Programs don’t create loyalty; excellent experiences create loyalty, and programs reward it.

Mistake 2: Treating All Customers Equally

Wrong: We provide the same service to everyone—fair and consistent.

Right: We segment by value and needs—deliver appropriate service levels.

Principle: Your top 20% of customers generate 80% of profit—invest accordingly.

Mistake 3: Measuring Satisfaction Instead of Loyalty

Wrong: 92% customer satisfaction—we’re doing great!

Right: 72% retention rate—32% of ‘satisfied’ customers still left us

Principle: Satisfaction Loyalty. Satisfied customers leave when competitors offer small discounts. Loyal customers stay despite premium pricing.

Mistake 4: Reactive Instead of Proactive

Wrong: Wait for the customer to have a problem, then try to fix

Right: Anticipate issues, prevent problems, proactively communicate

Principle: Prevention builds loyalty more than recovery (though both matter).

Conclusion

Customer loyalty is the most powerful growth lever in the fuel delivery business. When reliability, proactive communication, value-driven loyalty programs, and technology-enabled convenience come together, retention rises, costs fall, and customer lifetime value multiplies.

Instead of competing on price alone, fuel delivery companies that invest in strong customer retention strategies build durable relationships, predictable revenue, and long-term profitability. In an industry where switching is easy, loyalty is what truly sets market leaders apart.

Related Reading

Want to see how loyalty strategies translate into real-world success?

Theory matters, but results prove concepts. Explore customer loyalty in on-demand fuel delivery apps and discover how innovative business models are transforming the industry through customer-centric design. Learn whether mobile fuel delivery can actually replace traditional gas stations and what loyalty factors drive this potential transformation. Read the complete analysis here →

Frequently Asked Questions:-

Q1: How much should we spend on keeping existing customers vs. getting new ones

Most companies spend too much on acquiring new customers. The optimal split is about 60–70% on retention and 30–40% on acquisition, since keeping a customer costs 5–7× less than acquiring one.

Q2: How quickly can we see results from customer retention efforts?

Some improvements happen fast—like proactive communication—within 30–60 days. Loyalty programs and tech adoption show impact in 3–6 months, while full transformation can take 9–15 months. Early signs like engagement and satisfaction improve almost immediately.

Q3: Can loyalty programs really work for price-sensitive commodities like fuel?

Yes—but only if they focus on value, not just points. Programs that reward convenience, reliability, and cost-saving benefits can boost retention by 18–35%, even in competitive, price-driven markets.

Q4: How can small fuel delivery companies build customer loyalty effectively?

Small companies have an edge—they know their customers personally, can act fast, and build strong relationships. Start simple with personal outreach, service excellence, and recognition, then scale up to more structured loyalty programs as you grow.