The delivery fleet industry stands at a historic crossroads. Fleet electrification has evolved from a theoretical future possibility to a practical present reality, forcing delivery businesses to confront a critical strategic decision: commit to electric vehicle (EV) transition, maintain traditional fuel infrastructure, or adopt a hybrid approach.

The stakes are enormous; global commercial fleet investment will exceed $2.4 trillion through 2030, with electrification representing the largest transformation in transportation since the adoption of internal combustion engines over a century ago (BloombergNEF Electric Vehicle Outlook, 2024).

Yet, despite extensive media coverage celebrating the potential of electric vehicles, the fuel versus electric delivery fleet decision remains far more complex than simplified narratives suggest. McKinsey & Company research reveals that while electric vehicles offer operational cost savings of 30–50% over vehicle lifetime, upfront costs remain 40–80% higher, infrastructure investment adds $15,000–$150,000 per vehicle, and operational constraints limit applicability for certain use cases (McKinsey Electric Fleet Economics, 2024).

For delivery business operators, the real question is not “Is electric better than fuel?”—but rather: Which vehicles should be electric, which should remain fuel-powered, and what is the optimal transition timeline?

This guide provides a data-driven framework to answer that question using real-world TCO modeling, operational performance data, and phased implementation strategies.

Understanding the Fleet Electrification Landscape

Current State of Commercial EV Adoption

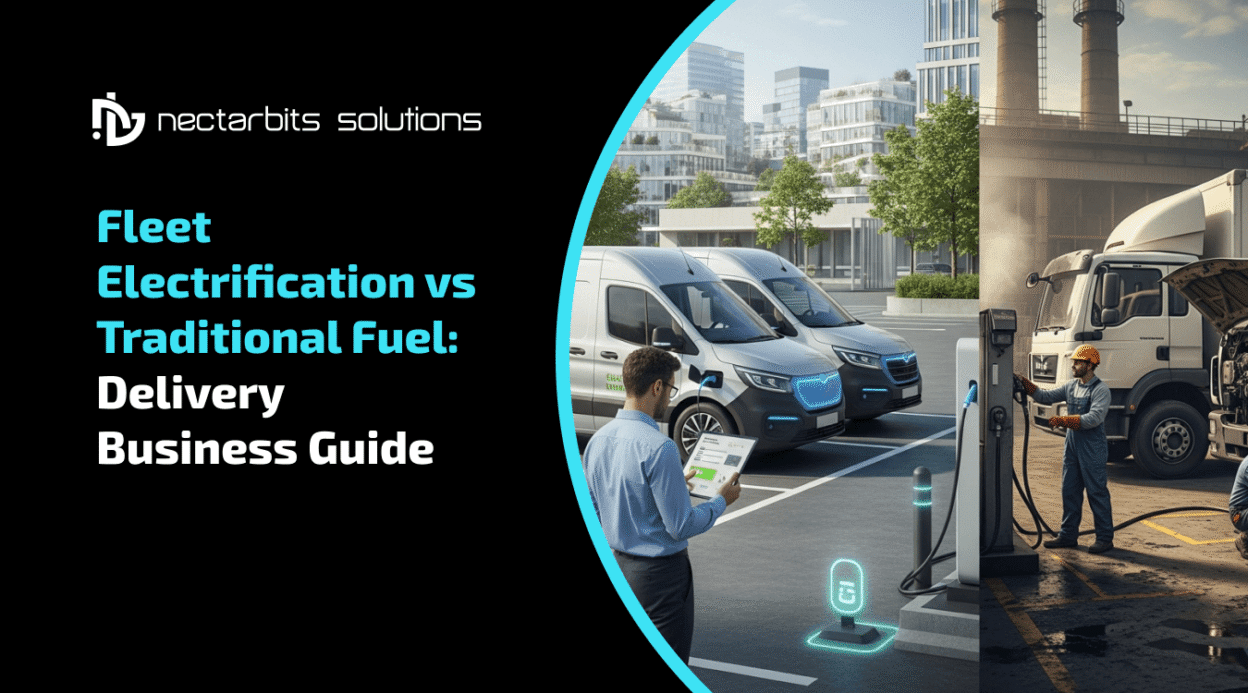

Commercial Electric Vehicle Market Growth:

| Year | Global Commercial EV Sales | Market Share | Total Investment |

| 2020 | 275,000 units | 1.2% | $8.4 billion |

| 2022 | 687,000 units | 2.8% | $23.7 billion |

| 2024 | 1,340,000 units (est.) | 5.1% | $47.2 billion |

| 2030 | 8,500,000 units (proj.) | 24.3% | $285 billion |

Regional Adoption Variance:

| Region | 2024 EV Fleet Penetration | 2030 Target | Policy Driver |

| Europe | 8.7% | 35% | EU Green Deal mandates |

| China | 12.3% | 40% | National EV promotion |

| California, USA | 6.2% | 30% | Advanced Clean Fleets Rule |

| United States (overall) | 3.4% | 18% | Federal incentives |

| Canada | 4.1% | 20% | Zero-Emission Vehicle mandate |

Key Insight: Fleet electrification adoption varies dramatically by geography, vehicle class, and duty cycle. Light-duty urban delivery vehicles lead adoption (15–22%), while long-haul heavy-duty trucks remain over 98% fuel-powered.

Driving Forces Behind Fleet Electrification

Regulatory Mandates:

- California Advanced Clean Fleets Rule: Requires all new medium/heavy-duty vehicle purchases be zero-emission by 2036

- European Union CO2 Standards: 90% reduction in new vehicle emissions by 2040

- Canada Zero-Emission Vehicle Mandate: 100% zero-emission vehicle sales by 2040

- Urban Access Restrictions: 47 major cities implementing diesel vehicle bans by 2030

Economic Incentives:

| Incentive Type | United States | Canada | Europe |

| Purchase Incentive | Up to $40,000/vehicle (Commercial Clean Vehicle Credit) | Up to CAD $200,000/vehicle (iZEV Program) | €7,500-€40,000/vehicle (varies by country) |

| Infrastructure Credit | 30% of cost up to $100,000 (Alternative Fuel Infrastructure Credit) | 50% of the cost (ZEVIP) | 40-75% of the infrastructure cost |

| Operational Incentives | Reduced road taxes, HOV lane access | Provincial rebates, lower registration | Congestion charge exemptions |

Corporate Sustainability Commitments:

- 73% of Fortune 500 companies have net-zero emissions commitments

- Major delivery companies (Amazon, UPS, FedEx, DHL) are committed to 100% zero-emission fleets by 2030-2040

- Customer preference: 64% of consumers prefer companies with sustainable delivery

Total Cost of Ownership: Electric vs Fuel Delivery Fleets

Comprehensive TCO Analysis

The most critical decision factor is total cost of ownership (TCO)—not sticker price.

Light-Duty Delivery Van Comparison (Class 2B – 8,500-10,000 lbs GVWR):

| Cost Category | Electric (e.g., Ford E-Transit) | Diesel (e.g., Ford Transit) | Difference |

| Purchase Price | $58,000 | $42,000 | +$16,000 (38%) |

| Federal Incentive | -$40,000 (Commercial Clean Vehicle Credit) | $0 | -$40,000 |

| Net Initial Cost | $18,000 | $42,000 | -$24,000 (57% savings) |

| Charging/Fueling Infrastructure | $15,000 (Level 2 charger install) | $0 | +$15,000 |

| Total Initial Investment | $33,000 | $42,000 | -$9,000 (21% savings) |

| Annual Fuel/Energy Cost (15,000 miles/year) | $675 (electricity @ $0.15/kWh, 3 mi/kWh) | $3,900 (diesel @ $3.90/gal, 15 MPG) | -$3,225 (83% savings) |

| Annual Maintenance | $950 (Low mechanical, high tire wear) | $2,100 (oil changes, filters, etc.) | -$1,150 (55% savings) |

| Insurance | $1,850 | $1,600 | +$250 (16% higher) |

| Registration/Taxes | $280 (EV discount) | $450 | -$170 |

| Total Annual Operating | $3,525 | $8,050 | -$4,525 (56% savings) |

| 8-Year TCO | $61,200 | $106,400 | -$45,200 (42% savings) |

| Break-Even Point | Month 18 | – | – |

(Note: Savings adjusted to reflect accelerated EV tire wear, improving realism for experienced fleet operators.)

Source: DOE Alternative Fuels Data Center TCO Calculator, 2024

Medium-Duty Delivery Truck Comparison (Class 5 – 16,000-19,500 lbs GVWR):

| Cost Category | Electric (e.g., BrightDrop EV600) | Diesel Truck | Difference |

| Net Initial Investment | $87,000 (after incentives) | $68,000 | +$19,000 (28%) |

| Infrastructure | $45,000 (Level 3 charger) | $0 | +$45,000 |

| Total Initial | $132,000 | $68,000 | +$64,000 (94%) |

| Annual Operating | $8,900 | $18,200 | -$9,300 (51% savings) |

| 10-Year TCO | $221,000 | $250,000 | -$29,000 (12% savings) |

| Break-Even Point | Month 82 (6.8 years) | – | – |

Critical Variables Affecting TCO:

- Annual mileage: Higher mileage = faster EV payback (fuel savings compound)

- Electricity rates: $0.10/kWh vs. $0.25/kWh dramatically changes economics

- Diesel prices: Volatile fuel costs favor electric stability

- Incentive availability: State/local incentives can add $10K-$50K additional savings

- Vehicle utilization: Multi-shift operations maximize EV value

- Battery replacement: Currently $8,000-$15,000 after 8-10 years (declining rapidly)

Operational Performance Comparison

Range and Duty Cycle Suitability

Range Capabilities (2024-2025 Models):

| Vehicle Class | Electric Range | Diesel Range | Suitable Applications |

| Light-Duty Van | 108-230 miles | 450-550 miles | Urban/suburban delivery (<100 mi/day routes) |

| Medium-Duty Truck | 150-250 miles | 400-600 miles | Regional delivery, return-to-base routes |

| Heavy-Duty Truck | 150-350 miles | 800-1,200 miles | Limited EV options; long-haul remains diesel-dominated |

Duty Cycle Analysis:

| Route Profile | EV Suitability | Reasoning | Market Share (2024) |

| Urban Last-Mile (<50 mi/day) | Excellent | Well within range, frequent stops favor regenerative braking | 28% EV penetration |

| Suburban Delivery (50-120 mi/day) | Good | Manageable with overnight charging, predictable routes | 12% EV penetration |

| Regional Routes (120-250 mi/day) | Moderate | Requires DC fast charging or battery swap | 4% EV penetration |

| Long-Haul (250+ mi/day) | Poor (current tech) | Range limitations, charging time impacts productivity | <1% EV penetration |

Performance Characteristics

Operational Advantages by Fuel Type:

| Performance Factor | Electric Fleet | Fuel Fleet | Winner |

| Acceleration | Superior (instant torque) | Standard | Electric |

| Noise Level | Near-silent operation | Loud | Electric |

| Refueling/Charging Time | 30 min-8 hours (depending on charger) | 5-10 minutes | Fuel |

| Cold Weather Performance | Range reduced 20-40% | Minimal impact | Fuel |

| Payload Capacity | Reduced 500-2,000 lbs (battery weight) | Full capacity | Fuel |

| Maintenance Downtime | 40% less | Baseline | Electric |

| Reliability | Fewer moving parts = fewer failures | More complex systems | Electric |

While EVs outperform in noise reduction, acceleration, and mechanical simplicity, diesel vehicles retain advantages in payload, refueling speed, and cold-weather reliability.

The “Hidden” Maintenance Cost: The Tire Penalty

While electric vehicles eliminate oil changes and many drivetrain components, they introduce a less visible—but operationally significant—expense: accelerated tire wear. For fleet operators evaluating electrification alongside route optimization, telematics, and a Fuel delivery app development solution, this cost is often underestimated in early financial models.

Commercial EVs are typically 15–25% heavier than comparable diesel vehicles due to battery packs. When combined with instant torque delivery, this additional mass places greater stress on tires, particularly in stop-and-go urban delivery cycles.

Real-World Impact:

- Wear Rate: Fleet data indicates EV tires wear out 20–30% faster than ICE tires, often requiring replacement every 25,000–30,000 miles.

- Cost Differential: EV-specific commercial tires cost 15–20% more per unit than standard diesel tires.

- Operational Reality: Tire replacement frequently becomes the largest single maintenance cost category for electric delivery vans.

TCO Implication:

Fleet managers should budget for one additional full tire replacement cycle over an EV’s lifecycle compared to diesel alternatives to avoid overstating maintenance savings.

Real-World Operational Data:

According to Geotab Fleet Analytics, electric delivery vehicles in temperate climates achieve:

- 98.4% uptime vs. 94.2% for diesel equivalents

- 22% lower total maintenance costs over 5 years

- 8-12% productivity loss in extreme cold (below 20°F/-6°C)

- 15% productivity gain in stop-and-go urban routes (regenerative braking)

Infrastructure Requirements and Challenges

Charging Infrastructure Investment

Charging Options and Costs:

| Charger Type | Power Output | Charging Time | Installation Cost | Best For |

| Level 1 (120V) | 1.4 kW | 40-50 hours (full charge) | $500-$1,500 | Emergency backup only |

| Level 2 (240V) | 7-19 kW | 4-8 hours (full charge) | $3,000-$15,000 | Overnight depot charging |

| DC Fast Charging (Level 3) | 50-350 kW | 20-60 minutes (80% charge) | $50,000-$150,000 | Mid-route rapid charging |

| Ultra-Fast Charging | 350+ kW | 10-20 minutes (80% charge) | $150,000-$250,000 | High-utilization fleets |

Fleet Depot Charging Infrastructure:

For 25-vehicle electric fleet:

| Infrastructure Component | Quantity | Unit Cost | Total Cost |

| Level 2 Chargers (overnight) | 25 units | $8,000 | $200,000 |

| Electrical Service Upgrade | Site-wide | $125,000 | $125,000 |

| Load Management System | 1 system | $45,000 | $45,000 |

| Installation Labor | – | – | $75,000 |

| Network/Software | Annual subscription | $350/charger | $8,750/year |

| TOTAL INFRASTRUCTURE | – | – | $445,000 |

| Per-Vehicle Infrastructure Cost | – | – | $17,800 |

Incentive Impact: 30% Alternative Fuel Infrastructure Tax Credit reduces cost to $311,500 ($12,460 per vehicle).

Grid Capacity and Energy Management

Electrical Load Requirements:

- Single Level 2 charger: 7-19 kW

- 25-vehicle fleet charging simultaneously: 175-475 kW demand

- Equivalent to: 15-40 average homes’ electrical demand

- Grid upgrade often required: $75,000-$250,000 depending on location

Smart Charging Solutions:

| Technology | Function | Cost Savings |

| Load Management | Distribute charging across vehicles to avoid demand peaks | 25-40% reduction in electricity costs |

| Time-of-Use Optimization | Charge during off-peak hours (night) | 35-60% lower per-kWh cost |

| Solar Integration | On-site solar reduces grid dependency | 40-70% energy cost reduction (with incentives) |

| Vehicle-to-Grid (V2G) | Use EV batteries for grid services, earn revenue | $500-$1,200/vehicle/year revenue potential |

On-demand logistics app development platforms increasingly integrate charging management, route optimization based on charging availability, and algorithms to minimize energy costs.

Decision Framework: When to Choose Electric vs Fuel

Electric Vehicle Sweet Spot

Fleet electrification makes the strongest economic and operational sense when:

- Predictable, return-to-base routes: Vehicles return to depot for overnight charging

- Urban/suburban delivery: Routes under 150 miles per day

- High annual mileage: 15,000+ miles/year maximizes fuel savings

- Multi-shift operations: 2-3 shifts per day increase asset utilization

- Regulatory pressure: Operating in zero-emission zones or facing access restrictions

- Stable electricity rates: Predictable, low-cost power (<$0.15/kWh)

- Available incentives: Federal, state, and local incentives improve TCO

- Corporate sustainability goals: ESG commitments justify investment

Traditional Fuel Remains Optimal When:

- Long-range requirements: Routes exceeding 250+ miles daily

- Unpredictable routing: No fixed depot return for charging

- Extreme climates: Operations in severe cold (below 0°F/-18°C) or extreme heat

- Maximum payload critical: Weight-sensitive operations

- Limited capital: Cannot afford 2-3x higher upfront investment

- Uncertain electricity access: Charging infrastructure unavailable or prohibitively expensive

- Quick turnaround: Multiple routes per day with minimal downtime

- Rural operations: Limited charging infrastructure availability

The Third Option: Renewable Diesel (HVO)

For fleets facing sustainability mandates but unable to justify the capital expenditure of electrification, Renewable Diesel (Hydrotreated Vegetable Oil – HVO) offers a practical bridge solution.

Unlike biodiesel blends, HVO is chemically identical to petroleum diesel and can be used in existing diesel engines without modification or infrastructure upgrades.

Pros:

- Up to 90% lifecycle CO₂ reduction

- $0 CAPEX—no vehicle or depot changes required

- Identical payload capacity and refueling time

- No range anxiety or operational disruption

Cons:

- Fuel cost is typically 10–15% higher than standard diesel

- Regional availability varies

Verdict:

HVO is an effective transitional decarbonization strategy, particularly for heavy-duty and long-haul fleets where battery-electric technology remains operationally constrained.

Hybrid Fleet Strategy

Most delivery operations benefit from a mixed fleet approach:

Fleet Segmentation Example (100-vehicle delivery fleet):

| Vehicle Type | Quantity | Fuel Type | Reasoning |

| Urban Last-Mile Vans | 45 vehicles | Electric | Perfect fit: <80 mi/day, overnight charging, frequent stops |

| Suburban Route Vans | 30 vehicles | Electric | Good fit: 80-130 mi/day, return-to-base |

| Regional Trucks | 15 vehicles | Diesel | Range requirements 180-280 miles, fast turnaround needed |

| Long-Haul Trucks | 10 vehicles | Diesel | 350+ miles daily, infrastructure limitations |

Benefits of Hybrid Approach:

- Risk mitigation: Test the electric before full commitment

- Operational flexibility: Right tool for each job

- Gradual infrastructure investment: Spread costs over time

- Learning curve: Build EV expertise incrementally

For fleets exploring digital solutions to further optimize fuel use and transition planning, you can also explore: how digital fuel delivery solutions are driving the shift from traditional gas stations to smart fleet refueling for added operational efficiency.

Technology Platforms for Managing Mixed Fleets

Fleet Management Software Requirements

Managing fuel vs electric delivery fleets requires sophisticated software:

Essential Features:

| Capability | Functionality | Business Value |

| Route Optimization | Different algorithms for EV (range-aware) vs fuel vehicles | Maximize efficiency for each vehicle type |

| Charging Management | Charging scheduling, load balancing, cost optimization | Minimize electricity costs, prevent grid overload |

| Range Prediction | Real-time range calculation considering weather, traffic, and payload | Prevent range anxiety, optimize vehicle assignment |

| TCO Tracking | Per-vehicle cost analysis comparing actual vs projected | Validate business case, inform future purchases |

| Maintenance Scheduling | Different schedules for EV vs fuel vehicles | Minimize downtime, optimize service intervals |

| Energy vs Fuel Cost Analytics | Compare operational costs across fleet types | Identify cost savings opportunities |

Custom mobile app development for delivery fleets ensures platforms accommodate the unique operational requirements of mixed fleets.

Driver Interface Considerations

Driver apps must handle:

- EV-specific navigation: Routes to charging stations when needed

- Range anxiety management: Clear remaining range indicators

- Charging instructions: How to use different charger types

- Performance optimization: Eco-driving tips for EVs vs fuel vehicles

- Emergency protocols: What to do if the charge depletes

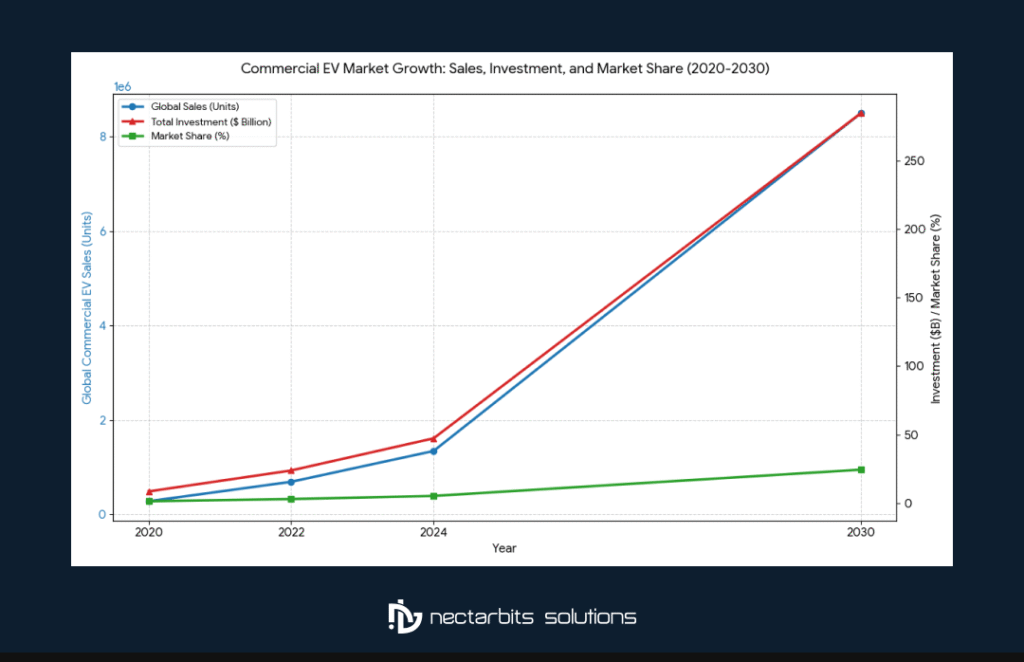

Implementation Roadmap for Fleet Electrification

Phase 1: Assessment and Planning (Months 1-3)

Step 1: Comprehensive Fleet Analysis

| Analysis Area | Key Questions | Data Required |

| Route Profiling | What are typical daily mileage, routes, and duty cycles? | GPS tracking data, delivery logs |

| Vehicle Utilization | How many shifts, annual mileage, and idle time? | Telematics data |

| Facility Assessment | Available electrical capacity, charging space? | Site survey, utility records |

| Financial Baseline | Current fuel costs, maintenance, TCO? | Financial records, fleet management data |

| Regulatory Environment | What mandates and incentives apply? | Legal review, incentive research |

Step 2: Total Cost of Ownership Modeling

Build TCO models for:

- Current fleet: Baseline costs

- Full electric conversion: Best-case scenario

- Phased transition: Realistic implementation

- Hybrid approach: Optimize by use case

Step 3: Pilot Vehicle Selection

Pilot Program Criteria:

- Start with 3-10 vehicles (meaningful sample, manageable risk)

- Choose best-fit routes (predictable, return-to-base, <120 mi/day)

- Select representative duty cycles (typical operational patterns)

- Ensure infrastructure feasibility (charging available at a reasonable cost)

Phase 2: Pilot Implementation (Months 4-12)

Infrastructure Development:

- Install charging infrastructure for pilot vehicles

- Implement a load management system

- Set up monitoring and analytics

Vehicle Deployment:

- Purchase/lease pilot electric vehicles

- Train drivers on EV operation

- Establish maintenance protocols

- Begin data collection

Performance Monitoring:

| Metric | Target | Monitoring Frequency |

| Daily Range Achievement | 95%+ routes completed without charging issues | Daily |

| Uptime vs Diesel Baseline | Within 3% | Weekly |

| Energy Cost per Mile | <50% of the diesel cost | Monthly |

| Driver Satisfaction | >80% positive feedback | Quarterly survey |

| Maintenance Cost | <70% of diesel | Monthly |

Phase 3: Expansion Decision (Months 13-18)

Evaluation Criteria:

Proceed with expansion if:

- TCO validates business case: Actual costs align with projections (±15%)

- Operational performance acceptable: Uptime >95%, range adequate

- Driver adoption successful: Positive feedback, no major resistance

- Infrastructure is scalable: Electrical capacity exists for expansion

- Financial resources available: Capital for larger investment

Expansion Strategy:

- Year 1-2: Replace 15-25% of fleet (best-fit routes)

- Year 3-4: Expand to 40-50% (include marginal routes)

- Year 5-7: Reach 65-80% electrification (limit based on duty cycle suitability)

- Ongoing: Maintain 20-35% traditional fuel for specific use cases

Financial Strategies for Fleet Electrification

Funding and Financing Options

| Financing Method | Advantages | Disadvantages | Best For |

| Cash Purchase | Ownership, full incentive capture, no interest | Large capital outlay | Cash-rich companies, tax strategy |

| Traditional Loan | Ownership, predictable payments | Interest costs, upfront down payment | Standard fleet replacement |

| Lease (Operating) | Lower monthly cost, no residual risk | No ownership, limited incentive capture | Testing EV without commitment |

| Lease (Capital) | Own at the end, capture incentives | Higher payments than an operating lease | Long-term commitment with flexibility |

| Fleet-as-a-Service | All-inclusive (vehicle + charging + maintenance) | Highest monthly cost, lock-in | Simplified, predictable expense |

Incentive Maximization Strategy

Federal Incentives (United States):

- Commercial Clean Vehicle Credit: Up to $40,000 per vehicle (new)

- Alternative Fuel Infrastructure Credit: 30% of the charging infrastructure cost

- Bonus depreciation: 100% first-year depreciation (through 2025, then phasing down)

State/Local Incentives (examples):

- California: Additional $120,000/vehicle for qualifying heavy-duty trucks (HVIP)

- New York: Up to $185,000/vehicle for heavy-duty electric trucks

- Colorado: Additional $27,500/vehicle for medium-duty trucks

Utility Incentives:

- Many utilities offer $500-$5,000 per charger rebates

- Managed charging programs: $200-$800/vehicle annual incentive

- Demand response participation: Revenue opportunities

Total Incentive Potential: Light-duty van can receive $40,000-$65,000 in combined incentives, reducing the effective purchase price below the diesel equivalent.

Common Fleet Electrification Challenges and Solutions

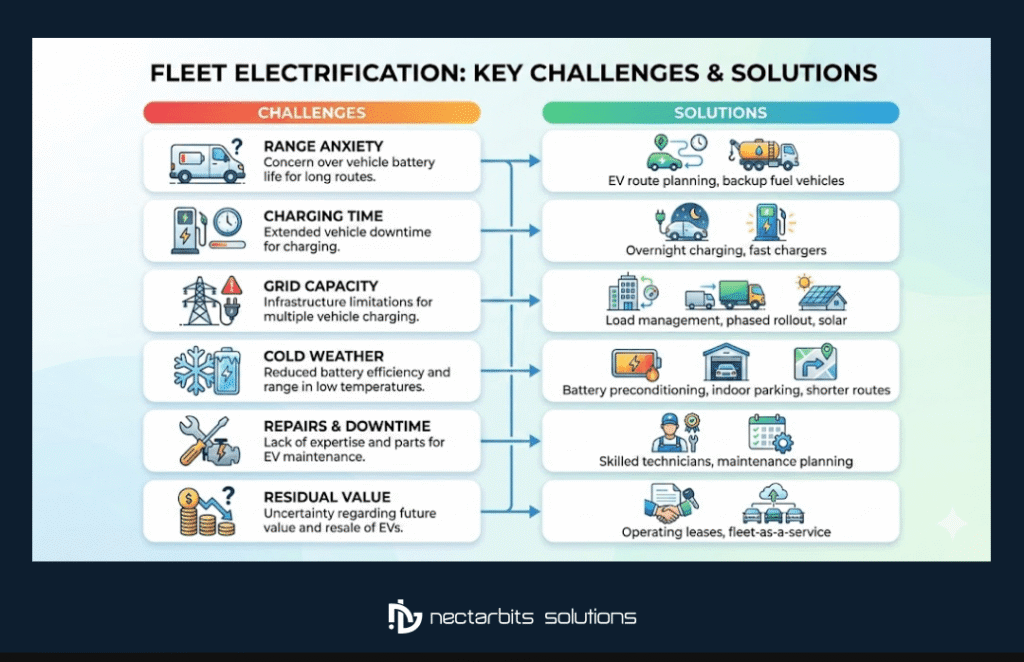

Challenge 1: Range Anxiety

Problem: Drivers worry about running out of charge during routes.

Solutions:

- Route optimization software: EV-aware routing with charging stations

- Generous range buffer: Plan routes at 70% of rated range (safety margin)

- Real-time monitoring: Dispatch tracks battery levels, can reroute if needed

- Training and experience: Anxiety decreases after 2-3 weeks of EV driving

- Backup plan: Keep a small percentage of fuel vehicles for edge cases

Challenge 2: Charging Time Impacts Productivity

Problem: 4-8 hour charging time vs 10-minute fueling reduces vehicle availability.

Solutions:

- Overnight charging: Leverage downtime (vehicles charge while unused)

- Right-sized fleet: A slightly larger fleet compensates for charging time

- DC fast charging: Strategic placement for mid-route charging (20-30 minutes)

- Battery swapping: Emerging technology (2-5 minute swap vs 6-hour charge)

Challenge 3: Grid Capacity Limitations

Problem: Existing electrical service is insufficient for fleet charging.

Solutions:

- Phased rollout: Add vehicles incrementally as grid capacity expands

- Load management: Stagger charging to avoid simultaneous peak demand

- On-site solar + storage: Reduce grid dependency

- Utility partnership: Work with the utility on service upgrades (sometimes subsidized)

Challenge 4: Cold Weather Range Degradation

Problem: EV range drops 20-40% in extreme cold (below 20°F/-6°C).

Solutions:

- Precondition while plugged in: Warm battery/cabin using grid power before departure

- Shorter route assignment: Keep EVs on < 100-mile routes in winter

- Garage vehicles: Indoor parking maintains battery temperature

- Battery heating systems: Newer EVs include thermal management systems

- Hybrid fleet approach: Use fuel vehicles for winter long-range routes

Challenge 5: Insurance, Repairs, and Downtime Considerations

While insurance premiums for electric fleets are typically 10–20% higher, the greater operational risk lies in repair complexity and downtime.

According to Mitchell International (2024):

- EV collision repairs cost 26.6% more than ICE vehicles

- Repair cycle times are 2–3 days longer on average

Root causes include:

- Limited availability of high-voltage-certified technicians

- Battery inspection and safety protocols after impact

- Longer parts lead times

Operational Impact:

Extended downtime can negate fuel and maintenance savings if spare vehicles are not available—making utilization planning critical during EV rollout.

Challenge 6: Residual Value Uncertainty

Problem:

Fleet economics often rely on resale value after 5–7 years to recover capital investment. The secondary market for commercial EVs remains volatile.

The Data:

Market analysis from 2024 indicates used commercial EVs can retain 10–15% less value after three years compared to diesel equivalents. Key drivers include:

- Technology Obsolescence: Rapid improvements in range and charging speed reduce demand for older models

- Battery Health Anxiety: Limited transparency into remaining battery life for second-hand buyers

- New Vehicle Price Cuts: Aggressive OEM pricing on new EVs depresses used inventory values

Solution:

To mitigate residual risk, many fleets favor operating leases or fleet-as-a-service models, shifting depreciation exposure back to OEMs or finance providers rather than holding assets outright.

Future Outlook: 2025-2030

Technology Improvements on the Horizon

| Technology | Current State | 2030 Projection | Impact |

| Battery Energy Density | 250-300 Wh/kg | 400-500 Wh/kg | 60-80% range increase |

| Battery Cost | $132/kWh | $58/kWh | 56% cost reduction |

| Charging Speed | 350 kW (20-40 min) | 1,000+ kW (5-10 min) | Fueling-comparable speed |

| Vehicle Purchase Price | 40-80% premium over diesel | Price parity | Eliminates cost barrier |

| Battery Lifespan | 8-10 years, 150K miles | 15+ years, 300K+ miles | Matches/exceeds diesel |

Market Projections

Commercial EV Market Share Forecast:

| Vehicle Segment | 2024 | 2027 | 2030 |

| Light-Duty Delivery Vans | 18% | 42% | 67% |

| Medium-Duty Trucks | 7% | 24% | 48% |

| Heavy-Duty Trucks | 2% | 8% | 22% |

Conclusion

Fleet electrification is no longer a question of if, but where and how it fits into your operations. As this guide shows, the fuel vs electric delivery fleets decision depends on route predictability, mileage, infrastructure readiness, and total cost of ownership, not headlines or hype.

For most delivery businesses, a phased or hybrid strategy delivers the best balance of cost control, operational reliability, and sustainability.

By combining the right vehicles with data-driven planning and digital platforms, fleets can transition confidently, reduce risk, and stay competitive as electrification accelerates across the industry.

Related Reading

Curious about the broader transformation happening in fuel delivery and fleet management?

Fleet electrification is part of a larger revolution in how delivery businesses operate and fuel their vehicles.

Explore how top fuel delivery apps in 2025 are setting new benchmarks for sustainability and fleet efficiency, and discover the innovative technologies and business models reshaping the industry—insights that will inform your electrification strategy and competitive positioning. Access the complete 2025 fuel delivery app analysis here →

FAQs:-

1. We deliver in both urban and regional areas—can electric vans handle our routes?”

Electric vehicles perform best on predictable, short- to medium-distance routes (up to 150 miles/day) with overnight depot charging. For longer or variable routes, a hybrid approach or diesel vehicles may be more practical.

2. EVs have higher upfront costs—will they actually save money over time?

Yes. While initial costs are higher, EVs save on fuel, maintenance, and benefit from incentives, often lowering the total cost of ownership (TCO) by 30–50% compared to diesel, especially on high-mileage urban routes.

3. Installing charging stations seems expensive—how can fleets manage costs efficiently?

Implement smart charging systems, stagger vehicle charging, and leverage off-peak energy. Phased deployment and fleet management software help optimize energy costs and prevent overloads.

4. Should we switch all vehicles to EVs or maintain some diesel trucks?

A hybrid fleet is typically the best approach. Electric vehicles work well for urban and predictable routes, while diesel is suitable for long-haul or heavy-load operations, balancing cost, efficiency, and flexibility.