Quick Summary

Modern fuel inventory management systems utilize IoT sensors, cloud computing, and predictive analytics to maintain optimal fuel levels, eliminating costly stockouts while preventing expensive overstock situations. These automated solutions typically reduce inventory carrying costs by 35-50% and eliminate 80-90% of emergency deliveries through precise demand forecasting and automated replenishment triggers.

It’s 6 AM at a busy delivery yard. A fleet manager arrives expecting a smooth start—only to discover that several trucks can’t leave because their tanks are unexpectedly low. Dispatchers rush to rearrange routes, drivers wait helplessly, and frustrated customers begin calling within minutes. Situations like this aren’t random; they’re the result of an unreliable fuel inventory management system and the lack of modern tools like custom fuel delivery software development that ensure real-time visibility.

Today’s logistics operations operate under intense pressure. Fuel prices shift constantly, delivery margins are shrinking, and customers now expect every order to arrive on time, every time. In this environment, maintaining the right fuel levels becomes a critical balancing act. Stockouts paralyze operations, while overstock traps valuable cash, increases storage risks, and exposes businesses to price drops.

This blog will show you how to take full control of your fuel inventory. You’ll learn practical strategies—from accurate forecasting to smart ordering, technology adoption, supplier coordination, and modern mobile fueling solutions. By the end, you’ll have a clear roadmap to keep your fleet running without disruptions while cutting costs and improving delivery performance.

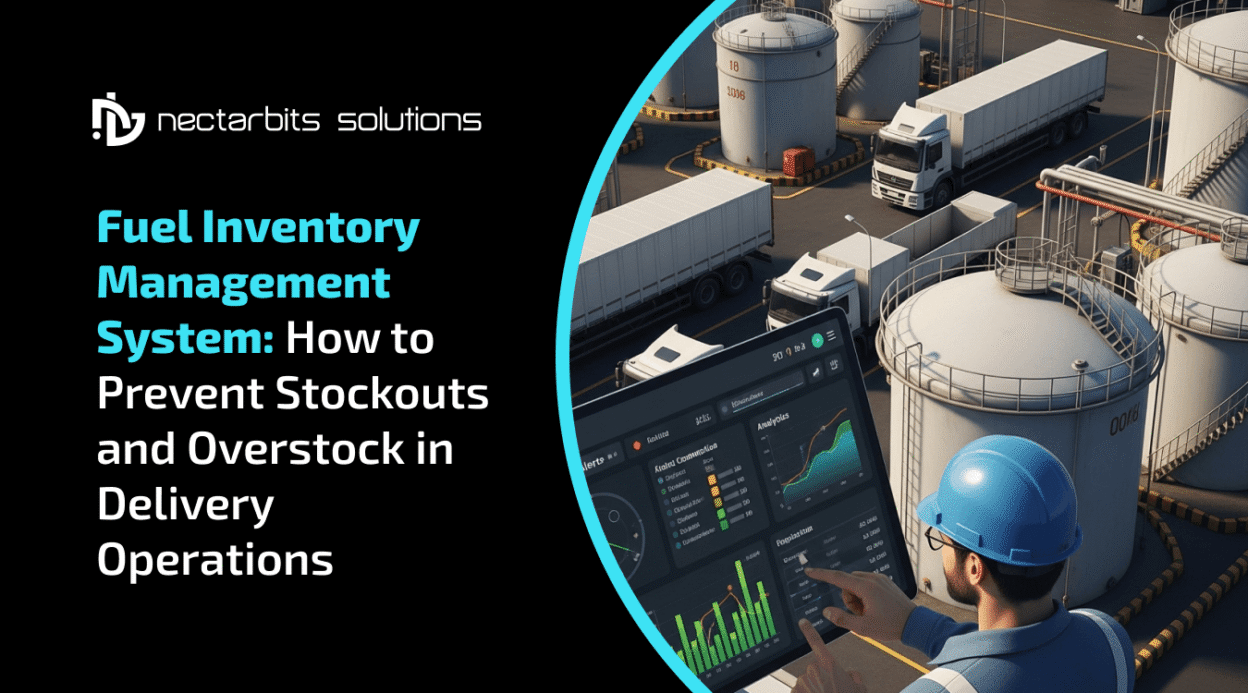

Key Statistics: The Real Cost of Poor Fuel Inventory Management

Poor inventory visibility directly impacts revenue, customer satisfaction, and operational efficiency. Here’s what industry data reveals:

- ₹75,000–₹150,000 in annual losses for mid-sized fuel distributors due to stockouts, overstock, and inefficient routing.

- 45–60% higher operational cost for emergency or unscheduled deliveries compared to planned dispatches.

- Up to 35% fuel waste is linked to weak logistics coordination and inaccurate tank monitoring.

- 75–85% accuracy with manual inventory tracking vs. 98–99.5% accuracy using automated IoT-based systems.

- 80–90% reduction in emergency delivery frequency and cost after implementing real-time tank monitoring.

- 12–18 months average ROI for companies adopting modern fuel inventory management systems.

Source: American Petroleum Institute – Fuel Distribution Efficiency Report

Understanding Fuel Inventory Management in Delivery Operations

Fuel inventory management is the complete process of planning, purchasing, storing, monitoring, and replenishing fuel for fleet-based businesses. Unlike standard inventory, fuel is a volatile, perishable, and highly regulated resource—making it far more complex to manage. Delivery companies rely heavily on a fuel inventory management system because fuel availability directly determines whether vehicles move, orders get delivered, and service commitments are met.

Within a delivery operation, fuel flows through a continuous lifecycle:

Procurement → Storage → Fleet Fueling → Consumption → Monitoring →Replenishment.

Any inefficiency in this chain—whether a delay in procurement or poor tank visibility—creates operational risk.

Fuel is fundamentally harder to manage than typical inventory for several reasons:

1. Fuel quality deteriorates.

Diesel can absorb moisture, form microbial growth, or develop sludge, especially when stored for long periods. Contaminated fuel reduces engine efficiency, increases breakdowns, and shortens asset life. This makes fuel storage optimization essential for maintaining fuel quality and minimizing waste.

2. Prices change unpredictably.

Fuel prices fluctuate daily based on crude oil markets, regional taxes, and supply-demand shifts. A poorly timed purchase can inflate annual fuel spend by 8–15%. Managing these swings requires accurate forecasting and smart purchasing strategies.

3. High compliance requirements.

Fuel storage tanks, transfer equipment, and delivery processes must meet strict fire safety, hazardous material handling, and environmental regulations. Non-compliance can result in fines, leaks, contamination incidents, or forced shutdowns—making regulatory oversight a core responsibility.

4. Fuel powers the entire delivery ecosystem.

Without diesel or petrol, vehicles cannot move. A single stockout can halt dispatches, disrupt delivery logistics planning, and trigger cascading delays across the supply chain. Even a brief 2–3 hour fueling interruption can push routes off schedule, increase overtime, and damage customer trust.

Because every route, driver, and delivery depends on uninterrupted fuel access, modern fleets use advanced inventory tools and automated fuel storage management systems to balance supply, prevent shortages and overstock, and ensure smooth day-to-day operations.

The High Cost of Stockouts: Why Fuel Shortages Are a Fleet’s Most Expensive Failure

Fuel stockouts are one of the most damaging—and most avoidable—failures in delivery operations. When fuel unexpectedly runs out, the entire system grinds to a halt. Trucks stay parked, dispatch teams panic, delivery windows collapse, and customer promises fall apart. What starts as a simple lapse in fuel planning instantly becomes an operational emergency that can cost a fleet thousands of dollars within hours.

Stockouts are not just an inconvenience—they are a direct threat to financial performance, customer trust, and operational stability.

1. Operational Paralysis: When Trucks Stop, the Business Stops

Fuel shortages freeze the entire delivery chain. Drivers arrive on time, but vehicles cannot move. Dispatchers must reschedule routes, push jobs into later time windows, and rebuild plans manually—often at the worst possible moment.

A stockout forces:

- Missed dispatch windows

- Route reshuffling

- Lower route density

- Delayed or incomplete deliveries

For fleets running tight delivery schedules, even a 2–3 hour fueling disruption can wipe out a full day’s efficiency. By the time operations recover, customer commitments are already broken, and next-day schedules are compressed.

This sudden collapse of workflow also disrupts delivery logistics planning, creating a domino effect that lasts for days.

2. Financial Losses: Stockouts Are Shockingly Expensive

Fuel emergencies drain budgets faster than most fleet managers realize.

Here’s where the costs hit hardest:

- Emergency fuel sourcing is 20–35% more expensive

- Rush deliveries or small-volume top-ups add another 10–15%

- Drivers paid overtime to complete jobs pushed into late hours

- SLA penalties and compensation for missed delivery windows

- Lost revenue as canceled routes reduce daily capacity

Across industry reports, fleet downtime costs range from $3,500 to $25,000 per day, depending on fleet size.

A single stockout can wipe out the profit margin for an entire week.

3. Customer Damage: One Stockout Can Lose an Entire Contract

Delivery customers expect reliability—not excuses. When a delivery fails because a company “ran out of fuel,” trust breaks instantly.

Real consequences include:

- Frustrated customers and escalations

- Negative reviews on transport and logistics platforms

- Onboarding of competitor fleets

- Loss of long-term, high-value contracts

Studies show customer retention drops 12–18% after repeated fuel-related delivery failures.

In an industry where relationships drive revenue, a single stockout can open the door for competitors to step in.

4. Team Morale: Internal Frustration That Slows the Entire Business

Stockouts drain team morale more than most operational issues.

- Drivers feel their time is wasted

- Dispatchers spend hours firefighting instead of planning

- Managers lose confidence in operational control

Over time, this leads to burnout, poor performance, and higher turnover—further increasing organizational costs.

A fuel stockout is not a small operational mistake—it is an expensive, reputation-damaging failure with long-term impact. It cripples productivity, inflates costs, damages customer relationships, and erodes team morale.

For any delivery business aiming for consistency and profitability, preventing stockouts must be a non-negotiable priority.

The Hidden Burden of Overstock: Why Too Much Fuel Is Just as Dangerous as Too Little

Many fleet operators assume storing extra fuel is the “safer” choice—insurance against sudden demand spikes or supplier delays. But in reality, fuel overstock is an expensive and risky operational mistake. The more excess fuel a company stores, the more capital it traps, the more maintenance it pays for, and the more regulatory exposure it carries. In the long run, overstock quietly drains profits just as fast as stockouts disrupt operations.

Modern tools like a logistics app development solution can help fleets avoid such imbalances by improving visibility and forecasting.

Fuel may seem like a strategic buffer, but holding more than you need can turn storage tanks into silent liabilities

1. Capital Lock-In: Excess Fuel = Frozen Cash Flow

Fuel is one of the largest recurring expenses in delivery operations, and overstocking forces fleets to tie up tens of thousands of dollars in liquid assets that generate zero return.

Industry data shows:

- Mid-size fleets often trap $50,000–$100,000+ in unnecessary fuel inventory.

- Large enterprise fleets may immobilize $250,000–$500,000 when over-purchasing during high-demand months.

This locked capital could otherwise fund vehicle maintenance, technology upgrades, additional drivers, or fuel storage optimization initiatives that improve long-term cost efficiency. Instead, it sits idle—losing value every day fuel prices fluctuate.

2. Storage Costs & Quality Risk: Fuel Deteriorates Over Time

Fuel doesn’t stay stable forever. Long storage periods increase risks such as:

- Water accumulation

- Microbial growth (diesel bugs)

- Sediment formation

- Filter plugging and injector damage

These quality issues lead to engine wear, reduced mileage, more breakdowns, and downtime. Contaminated fuel also demands:

- Tank cleaning: $1,500–$6,000 per tank

- Polishing or filtering: $0.50–$1 per gallon

Moreover, larger tanks or higher fuel volumes increase:

- Insurance costs

- Spill-prevention maintenance

- Fire-safety compliance expenses

- Hazardous material handling requirements

Over time, storing more fuel than necessary becomes an operational burden rather than an asset.

3. Price Risk Exposure: Overstock Locks You Into Bad Pricing

Fuel prices move every day. Buying large quantities during a price spike leaves fleets stuck with expensive fuel even when the market drops.

For example:

If diesel drops by $0.20–$0.40 per gallon after an over-purchase, a fleet holding 20,000 gallons loses $4,000–$8,000 instantly.

Larger fleets can lose $25,000–$60,000 in a single price cycle.

Overstocking magnifies this risk dramatically.

4. Compliance & Safety Risks: More Fuel = More Regulation

Storing excess fuel increases exposure to:

- Environmental storage regulations

- Fire-safety inspections

- Spill-prevention and containment rules

- Hazardous material handling audits

Violations often result in fines ranging from $2,000 to $25,000, depending on the severity and the state/province. Insurers also charge higher premiums for sites with large fuel reserves because the risk of leaks, fires, and contamination is significantly higher.

Overstock may feel like a safety net, but it’s actually a costly and high-risk strategy. It locks up capital, increases regulatory exposure, accelerates fuel degradation, and amplifies price volatility losses. A smarter approach is balancing inventory—not inflating it—using data visibility, automated alerts, and modern fuel planning technology.

Root Causes: Why Fuel Inventory Problems Occur

Fuel shortages and overstock situations don’t happen randomly—they’re usually the result of predictable operational gaps. Most delivery operations face the same underlying issues: outdated processes, missing data, weak coordination, and reactive decision-making. Understanding these root causes is the first step toward building a reliable, efficient, and financially sustainable fuel strategy.

1. Decisions Based on Guesswork Instead of Data

Many fleet managers still estimate fuel needs using experience, driver feedback, or “what feels right.” While intuition may help in small operations, it becomes dangerously inaccurate as fleets scale. Without structured data—such as usage histories, consumption patterns, and tank-level trends—companies either under-purchase or over-buy. Both outcomes create significant financial and operational risk.

2. No Real-Time Visibility Into Tank Levels

Manual dipstick checks or periodic gauge readings are slow, error-prone, and impossible to rely on for time-critical decisions. Tank levels can drop faster than expected due to:

- Unexpected route changes

- Longer idle times

- Higher-than-average consumption

- Temperature-related volume shifts

Without live visibility, teams often learn about shortages too late or fail to spot when tanks are filling beyond safe limits. This lack of transparency is one of the biggest drivers of both emergencies and excess storage.

3. Weak Supplier Coordination and Unpredictable Deliveries

Fuel supply chains vary dramatically depending on suppliers, regions, and contract terms. Delayed refills, incomplete deliveries, or unavailable transport vehicles can create last-minute shortages. On the other hand, some suppliers deliver early or in larger quantities than requested, pushing tanks past optimal storage levels. Poor communication—combined with unclear delivery windows—leads to repeated misalignment between expected and actual supply.

4. Contributing Factors That Amplify Inventory Errors

Beyond operational gaps, several secondary factors worsen inventory problems:

- Seasonal demand changes not included in planning (e.g., holiday surges, peak harvest season, construction cycles).

- Fleet expansion without recalibrating storage capacity or procurement strategy.

- Poor internal communication between operations, finance, procurement, and dispatch teams.

- Outdated reorder points, often based on old tank capacities or incorrect consumption averages.

- Over-buying during temporary price dips which fills tanks beyond safe levels and increases financial exposure.

Fuel inventory problems are rarely caused by external shocks—most originate from internal blind spots that can be fixed with visibility, planning, and coordination. When teams understand these root causes, they can build a more predictable, efficient, and cost-controlled fueling operation.

Proven Strategies for Optimal Fuel Inventory Balance

Achieving the perfect balance between overstock and stockouts requires more than guesswork—it demands data, systems, and a proactive approach. The following proven strategies are used by top logistics companies, fuel distributors, and fleet operators to maintain consistent fuel availability while minimizing financial risk. Whether you manage a small fleet or a large multi-location operation, these methods provide the operational stability your delivery business needs. These strategies also help businesses understand the real fuel inventory management system development cost when planning long-term digital transformation.

A. Accurate Demand Forecasting

The foundation of reliable fuel management is understanding exactly how much fuel your fleet consumes over time. Accurate forecasting requires at least 6–12 months of historical data, preferably broken down by day, week, and season. This allows companies to identify trends such as morning usage spikes, weekly demand cycles, and seasonal shifts caused by weather or industry patterns.

Start by analyzing your records for:

- Daily gallons/litres consumed

- Variations across different types of vehicles

- Idle time versus driving time

- Seasonal peak periods (holidays, harvest, construction cycles)

This analysis helps you build a baseline consumption model, which becomes the reference point for all future fuel planning. Once a baseline is created, you can apply modifiers such as fleet growth, new routes, or increased customer demand.

Essential Forecasting Calculations

Use these simple formulas used by operations teams worldwide:

- Average Daily Consumption:

Total fuel used ÷ Total number of days - Seasonal Adjustment Factor:

Peak month consumption ÷ Off-peak month consumption - Growth Factor for Expanding Fleets:

(Projected trips – Current trips) ÷ Current trips - Safety Stock Formula:

(Max daily usage × Max lead time) – (Avg daily usage × Avg lead time)

This safety stock acts as your buffer, protecting you from supplier delays, unexpected consumption spikes, and last-minute route changes.

B. Smart Reorder Points & Quantities

Even the most accurate forecast fails without the right reorder strategy. That’s where EOQ (Economic Order Quantity) and reorder points come in. EOQ is a simple planning tool that determines the ideal amount of fuel to order at once so you don’t overload storage or run dry.

How EOQ Helps Fleets

Instead of purchasing fuel whenever prices “look good,” EOQ bases ordering on:

- Demand rate

- Storage cost

- Delivery lead time

- Tank capacity

This minimizes carrying costs while ensuring availability.

Setting Min/Max Inventory Levels

To prevent both overstock and shortages, fleets should define:

- Maximum inventory limit – the highest safe and economical tank level

- Minimum inventory limit – the level at which fuel becomes operationally risky

- Reorder point – the exact moment a replenishment order should be placed

These levels depend on vehicle usage patterns, delivery schedules, and supplier performance.

Key Inventory Formulas

Operations managers rely on these formulas:

- Reorder Point (ROP):

(Avg daily consumption × Supplier lead time) + Safety stock - Maximum Inventory Level:

Safety stock + (Avg consumption × Time between orders) - Minimum Inventory Level:

Safety stock + Reorder quantity – Expected consumption during lead time

These numbers should be reviewed quarterly or whenever fleet size or delivery routes change significantly.

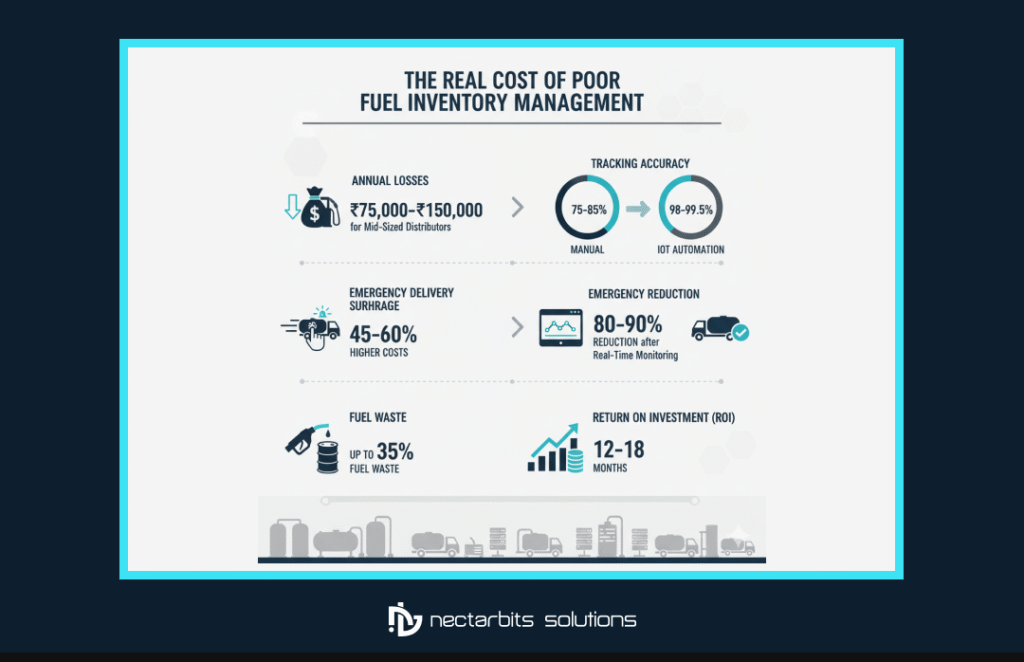

C. Real-Time Monitoring & Automation

Traditional tank checks—dipsticks, visual inspections, or daily gauge readings—are no longer enough. Modern delivery operations rely on a combination of IoT sensors, cloud-based platforms, and automated alerts to maintain accurate, real-time control over their fuel inventory.

How Technology Transforms Fuel Management

IoT tank sensors provide live tank-level data 24/7 and sync directly with cloud dashboards accessible from mobile or desktop. These systems alert managers instantly when consumption spikes, tanks drop below thresholds, or refills are due. This reduces human error and eliminates guesswork.

Automation takes it a step further:

When tank levels hit the reorder point, the system automatically sends a purchase request or triggers an order to your supplier. This ensures continuous availability without relying on manual checks.

Integrating fuel monitoring with fleet tracking, route management, and accounting software allows companies to analyze cost per route, fuel burn efficiency, and driver behavior. This holistic view helps identify inefficiencies, prevents theft, and improves budgeting accuracy.

Core Technologies to Implement

- 24/7 automated tank monitoring sensors

- Predictive analytics platforms that forecast usage

- Mobile fuel ordering apps for instant replenishment

- GPS-linked tracking for fleet consumption

- Cloud dashboards for live reporting and audits

These systems help fleets maintain stable, predictable fuel inventory while cutting administrative workload by 40–60%.

D. Strong Supplier Partnerships

Even with accurate forecasting and automation, fueling reliability ultimately depends on your suppliers. Building strategic relationships ensures that you receive consistent deliveries, fair pricing, and support during emergencies.

Just-In-Time (JIT) Delivery for Fleets

JIT fuel delivery aligns supply with real-time consumption. Instead of holding large volumes in storage, fleets receive smaller, more frequent deliveries that keep inventory levels optimal. This approach reduces carrying costs and lowers exposure to price swings.

Service-Level Agreements (SLAs) for Reliability

Clear SLAs outline:

- Delivery time windows

- Order accuracy targets

- Emergency delivery commitments

- Pricing models

A strong SLA ensures accountability and protects your operations from unpredictable supplier behavior.

Supplier Management Best Practices

- Maintain 2–3 approved suppliers to avoid dependency

- Negotiate flexible delivery schedules

- Ensure emergency fueling within 4–6 hours

- Enable automated ordering integration

- Conduct quarterly supplier performance reviews

Strong supplier partnerships reduce operational risk and ensure that your fueling process stays dependable across peak seasons and unexpected disruptions.

Step-by-Step Implementation Guide: Your 90-Day Fuel Inventory Transformation Roadmap

Implementing a modern fuel inventory management system doesn’t have to be overwhelming. With a structured 90-day rollout plan, fuel distributors, fleets, and delivery operators can transition from reactive inventory handling to a fully automated, predictive, and cost-efficient system. Below is a streamlined, real-world roadmap designed for operational teams, fleet managers, and business owners.

1. Conduct a Full Inventory Audit (Days 1–15)

Start by establishing a baseline. Capture your current stock levels, tank capacities, and fuel movement patterns. Review at least 90 days of historical consumption data to identify recurring issues like unplanned drops, overfilling, frequent emergency deliveries, or inaccurate manual readings. Pinpoint operational bottlenecks—such as slow reconciliation, leakage suspicions, or vendor delays—to understand the true cost of inefficiencies. This audit becomes the foundation for your optimization plan.

2. Calculate Optimal Inventory Levels (Days 15–30)

Using the audit insights, calculate optimal reorder points, safety stock, and maximum stock thresholds. Apply forecasting models (simple linear, seasonal, or AI-driven predictions) based on fleet size, demand variability, customer profiles, and seasonality. Adjust for lead times from suppliers. This step gives you a clear formula for how much fuel you need, when you need it, and how to prevent both stockouts and unnecessary carrying costs.

3. Select the Right Technology Stack (Days 30–45)

Choose inventory monitoring tools that fit your operational scale and budget. Options include IoT tank sensors, cloud dashboards, mobile apps, automated alerts, and ERP & fleet system integrations. Evaluate vendors based on device accuracy, API capabilities, GPS compatibility, uptime SLAs, reporting features, and total cost of ownership. A strong tech stack should give you real-time visibility, predictive analytics, automated replenishment, and seamless integration with your dispatching or fuel delivery systems.

4. Define Policies, SOPs & Governance (Days 45–60)

Document clear inventory management policies to create operational discipline. Assign roles for tank checks, replenishment approvals, reconciliation, and anomaly escalations. Define emergency procedures, such as what happens when levels drop below the reserve threshold. Establish workflows for supplier coordination, stock verification, and variance reporting. These SOPs ensure everyone—from drivers to supervisors—follows a consistent process, reducing errors and miscommunication.

5. Training & Controlled Rollout (Days 60–75)

Train your teams on the new tools and processes. Run the old manual system and the new automated system in parallel for 2–4 weeks to verify accuracy and troubleshoot issues. Encourage staff to report deviations, sensor errors, or dashboard inconsistencies. This hybrid approach helps refine system calibrations and builds user confidence before you fully switch to automated operations.

6. Monitor, Optimize & Scale (Days 75–90 and beyond)

Once the system goes live, track weekly KPIs such as inventory accuracy, lead time variance, emergency delivery rate, fuel shrinkage, and cost per delivered litre. Adjust reorder points and safety stock quarterly based on real-time insights and evolving demand patterns. Continually refine forecasting models and update SOPs to reflect operational changes. Over time, the system becomes smarter—and your operations become more efficient and profitable.Want deeper implementation insights? Explore our full guide on the advanced fuel inventory management system development cost.

Key Performance Metrics: How to Measure the Success of Your Fuel Inventory System

Once a modern fuel inventory management system is in place, the next step is ensuring it actually delivers measurable improvements. Clear KPIs help fuel distributors, fleet operators, and delivery businesses track performance, reduce operational risks, and maintain profitability. Below are the essential metrics that determine whether your inventory strategy is working—and where optimization is still needed.

Core KPIs That Define Inventory Efficiency

• Inventory Turnover Ratio (Target: 12–24× annually)

A higher turnover ratio indicates efficient stock movement and minimal dead stock. For most fuel businesses, turning inventory at least once every 15–30 days ensures healthy cash flow and reduces storage risk.

• Stockout Frequency (Goal: Zero; Maximum 1–2 per year)

Even a single stockout can lead to lost revenue, disrupted customer schedules, and emergency procurement. An optimized system—supported by sensors and forecasting—should drive stockouts close to zero.

• Days of Supply (Ideal Range: 3–10 Days)

This measures how long your current fuel levels will last. Maintaining a 3–10 day supply window balances operational readiness without locking unnecessary capital in excessive inventory.

• Carrying Cost Percentage (Keep Below 20%)

Carrying costs include storage, insurance, capital cost, monitoring, and potential fuel degradation. Efficient forecasting and timely replenishment should keep this under 20% of total inventory value.

• Order Accuracy Rate (Benchmark: 95%+)

This shows how closely supplier deliveries match your ordered quantities. High accuracy reduces reconciliation issues, improves planning, and builds trust with vendors.

• Price Competitiveness (Stay Within 2–5% of Regional Market)

Monitoring buying prices against local benchmarks ensures you stay competitive without overspending. This is especially crucial for distributors operating on thin margins.

• Emergency Purchase Percentage (Target: <5% of Annual Spend)

Emergency buys often come with higher transport charges and unfavorable fuel prices. Keeping this under 5% reflects strong planning and minimal operational surprises.

How Modern Fuel Delivery Apps Transform Inventory Management

On-demand fuel delivery apps have changed how fleets and businesses manage fuel, replacing manual checks and unpredictable deliveries with real-time visibility and automated planning. Using GPS-based ordering, live fuel availability, and dynamic pricing, these platforms ensure businesses get the right amount of fuel exactly when they need it—without maintaining large storage tanks or risking stockouts.

How These Apps Work

Modern apps detect a vehicle or tank’s location and fuel level, then allow instant ordering or auto-triggered refills. Live dashboards show fuel truck routes, inventory status, and pricing updates so fleets can plan fueling with full transparency.

Key Inventory Benefits

- Lower storage needs → reduced maintenance and compliance burden

- 30–50% lower carrying costs thanks to minimized on-site inventory

- Better cash flow because capital isn’t tied up in excess fuel

- Zero emergency sourcing with predictive refills and automated scheduling

These apps integrate with IoT tank sensors, fleet telematics, and ERP tools to forecast usage accurately based on route planning, seasonal patterns, and historical consumption.

Smarter Ordering & Pricing

Transparent, real-time pricing helps fleets avoid overpaying during peak rate periods. Automated replenishment ensures consistent fuel levels, reducing both stockouts and costly overstock. Operators can track consumption, order history, and per-vehicle fuel usage from a single mobile dashboard.

How Nectarbits Fits Into the Future of Fuel Delivery

Nectarbits builds enterprise-grade fuel delivery platforms with GPS ordering, automated scheduling, IoT monitoring, route optimization, and digital payments—helping fuel companies modernize operations and strengthen inventory management through smart, data-driven technology.

Explore how: Custom fuel delivery software development boosts inventory control and fleet efficiency

.Industry-Specific Considerations for Fuel Inventory Management

Fuel inventory needs differ across fleet types, so the strategy must match the operation. A tailored approach ensures your fuel inventory management system delivers maximum efficiency.

Small & Medium Fleets

Smaller fleets need cost-effective, flexible solutions.

- Rely on on-demand fuel delivery instead of maintaining large storage tanks.

- Use shared or rented storage when demand is inconsistent.

- Adopt affordable IoT monitoring tools for real-time visibility.

Large Logistics Fleets

High-volume fleets require centralized control.

- Combine bulk purchasing with JIT (just-in-time) top-ups.

- Use multi-location dashboards to monitor tank levels across all yards.

- Integrate fueling data with ERP and routing systems.

Last-Mile Delivery Fleets

Short, frequent routes depend on quick fueling turnaround.

- Adopt mobile fueling during off-hours.

- Set up micro-storage tanks at key hubs.

- Use short-term forecasting to match daily/weekly demand.

Regional Factors

Local conditions also shape strategy:

- Weather impacts fuel performance and consumption.

- Regulations influence tank maintenance and compliance costs.

- Local price trends determine whether bulk or JIT buying is optimal.

A fleet-specific approach ensures smoother operations, lower costs, and more reliable fuel availability.

Future Trends in Fuel Inventory Management

Fuel management is entering a new era where data, automation, and sustainability reshape how fleets plan and control supply. As technology evolves, fleets need systems that are smarter, more transparent, and capable of managing multiple fuel types simultaneously.

AI-Driven Forecasting

Artificial intelligence is becoming the backbone of next-generation fuel planning. Modern AI models analyze weather patterns, traffic conditions, route data, telematics, and historical usage to predict fuel demand with 95%+ accuracy. This reduces both stockouts and overstock, while allowing fleets to order fuel exactly when needed—no guesswork, no emergency purchases.

Blockchain for Transparency

Blockchain is emerging as a powerful tool for fuel traceability and fraud prevention. It provides:

- Tamper-proof transaction records

- Quality and purity verification

- Real-time tracking of the entire fuel chain

For fleets, this means guaranteed fuel quality and reduced risk of supplier-related discrepancies.

Managing Multiple Fuel Types

The shift toward mixed-energy fleets—diesel, EV, CNG, hydrogen—adds new complexity. Fleets now need inventory systems that can:

- Track multiple fuel types simultaneously

- Forecast demand for each energy source

- Plan charging or fueling schedules

- Manage hybrid or transitional operations

This creates a new demand for unified platforms that can handle all energy categories seamlessly.

Sustainability & Carbon Reporting

As regulations tighten, fleets must measure and reduce carbon impact. New systems include:

- Built-in carbon emissions dashboards

- Green fueling strategies based on consumption patterns

- Optimization tools that reduce idle time and wastage

These trends are shaping a smarter, cleaner, and more transparent future for fuel management—one where data drives every decision and efficiency becomes standard.

Conclusion

Fuel inventory problems—whether stockouts or overstock—hurt operations and profits. The fix is adopting a smarter fuel inventory management system that delivers real-time visibility, accurate forecasting, and automated replenishment.

With modern tools, fleets can cut costs by 10–20%, reduce emergency purchases, and improve delivery reliability. Even small steps like adding tank sensors or refining reorder points make an immediate impact.

Start by improving just one area this week: forecasting, visibility, or automation.

In the end, effective fuel inventory management is about resilience—keeping trucks moving and your business competitive.

Frequently Asked Questions:

1. What is the ideal fuel inventory level for a delivery fleet?

Most fleets operate best with 3–10 days of fuel supply, depending on supplier reliability, route intensity, and seasonal fluctuations. Smaller fleets with consistent delivery schedules can stay closer to 3–5 days, while larger or multi-region fleets typically maintain 7–10 days for operational security.

2. How often should fuel inventory be monitored?

Ideally, fuel levels should be tracked in real time using IoT tank sensors or automated dashboards. If automation isn’t available, fleets should perform daily manual checks. Real-time monitoring reduces errors by 80–90% and eliminates last-minute emergencies.

3. What ROI can fuel inventory management technology deliver?

Most fleets see a full ROI within 3–9 months. Savings come from fewer emergency purchases, reduced overstocking, lower carrying costs, and more accurate planning. Many operations achieve 10–20% annual cost reduction by upgrading to automated systems.

4. How do fleets manage seasonal demand changes?

Adjust safety stock, reorder points, and forecast models based on at least 12 months of historical data. During peak seasons or weather extremes, increase buffers; during off-peak periods, tighten inventory to reduce carrying costs. Dynamic seasonal planning prevents both stockouts and overstock.