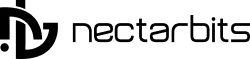

The fuel delivery industry stands at the threshold of its most transformative shift since the adoption of petroleum-based fuels over a century ago. The alternative fuels delivery business is experiencing unprecedented growth as North America accelerates toward clean energy adoption. According to Grand View Research, the global alternative fuels market is projected to reach $547.2 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.9% (Grand View Research Alternative Fuels Market Report, 2024).

For forward-thinking fuel delivery operators in Canada and the United States, this represents the next wave of opportunities beyond traditional gasoline and diesel. Hydrogen fuel delivery and biofuels distribution are not distant possibilities—they are emerging market realities creating competitive advantages for early adopters.

Statista reports that hydrogen demand in North America is expected to increase 600% by 2030, while biofuels consumption will grow 340% over the same period (Statista Energy Outlook, 2024). However, success in the alternative fuels delivery business requires more than just buying a truck; it demands strategic preparation across upstream sourcing, cold-weather operations, regulatory compliance, and digital infrastructure.

Understanding the Alternative Fuels Delivery Business Landscape

Why Alternative Fuels Are Reshaping North American Energy

The transition is driven by converging forces across Canada and the United States. It isn’t just about the environment; it is about economic viability and energy security.

Regulatory Drivers:

| Region | Key Policy | Impact on Alternative Fuels | Timeline |

| Canada | Clean Fuel Regulations | Mandates 15% carbon intensity reduction | 2024-2030 |

| California, USA | Low Carbon Fuel Standard (LCFS) | Requires renewable fuel credits, driving high demand | Active |

| USA (Federal) | Renewable Fuel Standard (RFS) | Mandates biofuel blending volumes & RINs trading | Annual targets |

| British Columbia | Renewable & Low Carbon Fuel Requirements | 20% renewable content by 2030 | 2024-2030 |

| Quebec | Cap-and-Trade System | Carbon pricing explicitly favors alternatives | Active |

Market Drivers:

- Corporate Sustainability: 72% of Fortune 500 companies have net-zero targets.

- Consumer Preference: 68% of North American consumers prefer businesses using clean energy.

- Energy Security: Reduced dependence on international petroleum markets.

The “Sourcing Gap”: Upstream Supply Chain Strategy

Most guides tell you how to sell fuel, but the biggest challenge in the alternative fuels delivery business is sourcing it.

- Hydrogen Offtake Agreements: You cannot buy hydrogen on the spot market like diesel. You must negotiate Offtake Agreements—long-term contracts (5-10 years) with producers to lock in supply.

- Grey Hydrogen: Sourced from natural gas (cheaper, higher carbon).

- Green Hydrogen: Sourced via electrolysis (premium price, zero carbon).

- Wholesale Biofuel Access: Relationships with major crushers and refiners (like ADM or local rendering plants) are essential to secure Renewable Diesel (RD) allocations, which are currently tight due to high demand in California and BC.

Hydrogen Fuel Delivery: The Clean Energy Frontier

Hydrogen fuel delivery involves transporting and dispensing hydrogen as an energy carrier for fuel cell electric vehicles (FCEVs), industrial heating, and logistics fleets.

Hydrogen Market Growth Statistics:

- North American Market: $18.4 billion (2024) → $62.7 billion (2030)

- Transportation Hydrogen: Projected CAGR of 34.1%

Infrastructure & Lead Times (Real-World Constraints)

Unlike diesel trucks which can be bought readily, hydrogen infrastructure has significant supply chain lag.

| Component | Specifications | Cost Range (USD) | Lead Time |

| Compressed Hydrogen Storage | 350-700 bar high-pressure tanks | $200k – $500k | 6-9 Months |

| Tube Trailer Transport | Multiple compressed cylinders | $300k – $600k | 9-12 Months |

| Liquid Hydrogen Tankers | Cryogenic transport trucks | $800k – $1.5M | 12-24 Months |

| Mobile Refueling Units | Portable dispensing systems | $150k – $400k | 6-12 Months |

Note: The 12-24 month lead time for cryogenic tankers is a critical planning factor. Orders must be placed well before customer contracts start.

Biofuels Distribution: Renewable Diesel vs. Biodiesel

In the biofuels distribution sector, nuances matter. The most critical distinction for North American operators is between Biodiesel (FAME) and Renewable Diesel (HVO).

- Biodiesel (FAME): Made by transesterification.

- Pros: Cheaper, lubricates engines.

- Cons: Gels in winter (requires heated storage), lower energy density.

- Renewable Diesel (RD): Made by hydrotreating (same process as petroleum diesel).

- Pros: Chemical twin to diesel, high Cetane, excellent cold weather performance, commands a 15-20% price premium.

- Cons: Supply is limited; high competition.

Biofuels Market Growth:

- North American Market: $68.3 billion (2024) → $136.7 billion (2030)

- Key Advantage: Drop-in capability means you can use existing storage tanks with minimal cleaning.

Operational Challenges: Cold Weather & Insurance

To rank as a top-tier operator, you must master the operational hurdles that scare off competitors.

Cold Weather Operations (Canada & Northern US)

Ignoring the weather in North America is a recipe for failure.

- Biofuel Cloud Point: Biodiesel can start crystallizing (clouding) at 0°C (32°F). You must manage “Pour Point” depressants and heated tank wraps.

- Hydrogen Nozzle Freeze: During rapid high-pressure dispensing, the expansion of gas causes extreme cooling. Hydrogen nozzles can freeze-lock to the vehicle. Your fuel delivery app development solution must monitor nozzle temperatures to regulate flow rates and prevent freezing.

Insurance and Risk Management

Insurance is the #1 barrier to entry for new entrants.

- Policies Required:

- Commercial General Liability with Pollution Liability limits ($5M+).

- Auto Liability: Must include the MCS-90 Endorsement (US) or specific dangerous goods riders (Canada) to cover environmental restoration in case of a spill.

- Cost Reality: Expect premiums to be 2-3x higher than standard fuel delivery until you have 3 years of safe operating history.

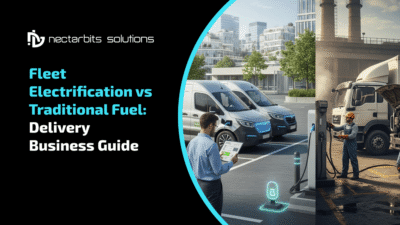

Digital Infrastructure: The Tech Stack Beyond the App

A modern alternative fuels delivery business cannot run on spreadsheets. It requires a sophisticated hardware-software ecosystem.

IoT and Vendor Managed Inventory (VMI)

High-value clients want reliability. By installing smart tank telemetry (IoT sensors) at your client’s site, you can offer VMI. The sensor tells your system when the tank is low, automatically scheduling a delivery.

The Software Backbone: Digital Infrastructure for Alternative Fuels

In the traditional fuel industry, software was primarily for dispatch and billing. In the alternative fuels delivery business, software is your compliance officer, your safety inspector, and your revenue engine. Because alternative fuels like Hydrogen and Renewable Diesel carry complex regulatory requirements and physical properties, off-the-shelf logistics software often fails.

Here is why partnering with an experienced custom web application development company is critical to building a platform that handles these unique complexities:

1. The Carbon Intensity (CI) Engine

For alternative fuels, the value isn’t just in the fuel itself, but in the Carbon Credits it generates (e.g., LCFS credits in California/BC, RINs in the US). These credits are calculated based on the fuel’s Carbon Intensity (CI) Score.

- How it Works: Your web platform needs a custom algorithm that calculates emissions across the entire lifecycle—from production (e.g., how the hydrogen was electrolyzed) to transportation (emissions from your delivery truck) to final dispensing.

- The Business Value: A lower CI score means higher credit value. A custom system tracks every variable to ensure you claim the maximum legal incentive value, often generating 15-20% additional revenue per delivery.

2. Real-Time Purity Monitoring (IoT Integration)

Hydrogen fuel cells are incredibly sensitive. A purity drop from 99.999% (Grade 5.0) to 99.97% can permanently damage a client’s $500,000 fuel cell vehicle.

- The Technical Solution: Your software must integrate with on-truck SCADA (Supervisory Control and Data Acquisition) systems and IoT sensors.

- The Feature: If the sensors detect moisture or impurities in the hydrogen stream during transport, the software triggers an automatic “Lockout Protocol,” physically preventing the nozzle from dispensing fuel. This protects you from massive liability claims.

3. Proof of Sustainability: The “Digital Passport.”

Corporate clients buying green fuel need irrefutable proof for their ESG reports. They can’t just take your word for it.

- Blockchain Integration: An advanced system creates a rigid “Chain of Custody.” When you source Green Hydrogen, a digital token is created. As that fuel is moved, stored, and delivered, the token moves with it on a digital ledger.

- Audit-Ready Reporting: When a client or government auditor asks, “Was this specific gallon truly renewable?” your system generates a blockchain-backed certificate—a “Digital Passport”—instantly verifying the fuel’s origin and green attributes.

4. The Customer Experience: Specialized Mobile Apps

While the web backend handles compliance, the customer experience happens on the phone. A specialized mobile app development company can build interface apps designed specifically for the nuances of alternative fuels.

- Dynamic Blend Selection: Unlike gas stations with fixed grades, biofuel clients have changing needs based on the weather.

- Feature: The app allows fleet managers to toggle blend ratios (e.g., requesting B20 for cost savings in summer, but automatically restricting orders to B5 or Renewable Diesel in winter to prevent gelling).

- Smart Asset Management: The app doesn’t just order fuel; it manages the vehicle’s health.

- Feature: For Hydrogen fleets, the driver scans the vehicle’s QR code. The app communicates with the vehicle’s tank data to ensure the pressure rating (350 bar vs. 700 bar) matches the delivery truck’s capability, preventing dangerous fueling errors.

- Real-Time Sustainability Dashboards: Give clients a reason to stay. The app should display a live counter of “CO2 Emissions Saved” and “Diesel Gallons Displaced” per delivery, which they can screenshot and share for their own PR.

By investing in a robust fuel delivery app development solution, you move beyond being a commodity provider and become a technology partner to your clients—locking in long-term loyalty in a competitive market.

Read More: Discover how digital transformation is redefining convenience retail for modern, on-demand customers in our comprehensive analysis. Fuel and Convenience: Rethinking Retail for On-Demand Customers

Regulatory Compliance: The “Three Pillars” & Safety

United States: The 45V Tax Credit

The Inflation Reduction Act’s 45V Credit (up to $3.00/kg for hydrogen) is the biggest incentive, but it comes with strict “Three Pillars” requirements:

- Additionality: Power must come from new clean energy sources.

- Temporal Matching: Production must match renewable energy generation (hourly matching by 2028).

- Deliverability: Power must be sourced from the same geographic grid region.

Safety Standards: Operations must comply with DOT 49 CFR (Hazmat transport) and ASME BPVC Section VIII (Pressure vessels).

Canadian Framework

- Transport: Compliance with the Transportation of Dangerous Goods (TDG) Act.

- Safety: Pressure vessels must meet CSA B51 standards.

- Incentives: The Clean Fuel Regulations create a market for generating and selling compliance credits.

Business Models & Marketing Strategy

Account-Based Marketing (ABM) with Pilot Programs

Alternative fuel is a B2B sale with a long cycle. Don’t just “market”—launch Pilot Programs.

- Strategy: “The Try-Before-You-Buy Model.” Offer a mobile refueler for 3 months to a logistics fleet.

- Goal: Prove cost savings and reliability before asking for a 5-year contract.

Revenue Streams

- Core Fuel Sales: 60-70% of revenue.

- Carbon Credit Trading: 10-15% of revenue (Pure profit).

- Infrastructure Consulting: Charging clients to help design their on-site storage.

Financial Planning: Investment & ROI

Biofuels Distribution Investment:

- Total Investment: $230,000 – $1.475M

- Breakeven: 14-22 months

- 3-Year ROI: 180-320%

Hydrogen Delivery Investment:

- Total Investment: $1.3M – $5.8M

- Breakeven: 24-36 months

- 5-Year ROI: 250-450%

Why the difference? Biofuels leverage existing trucks with minor retrofits ($10k-$40k). Hydrogen requires specialized tube trailers ($400k+) and high-pressure compression equipment.

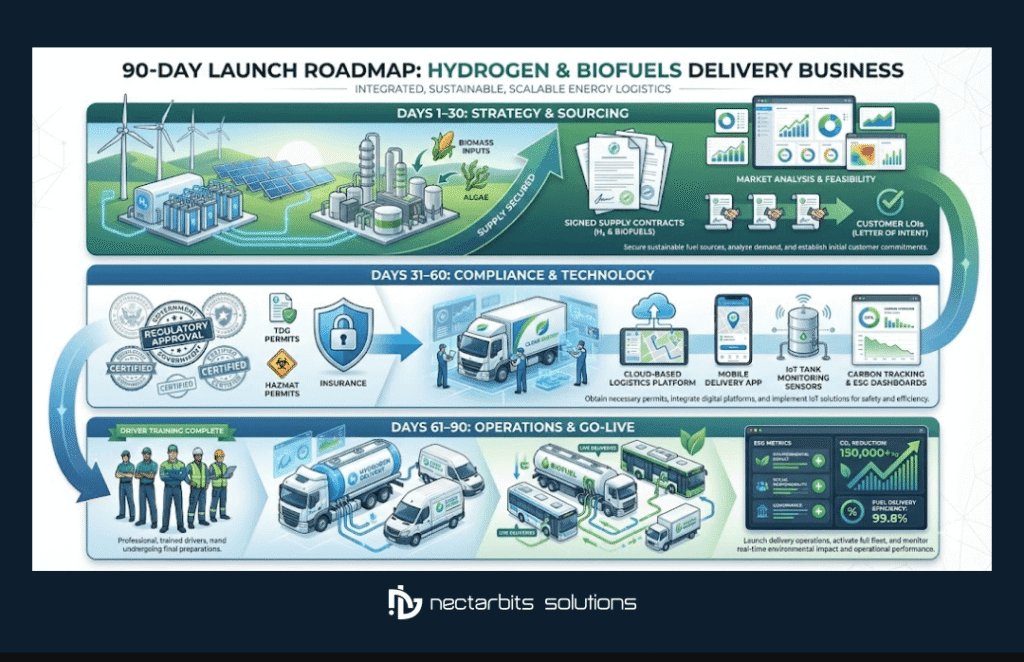

The 90-Day Launch Roadmap

How do you go from idea to operation?

- Days 1-30: Feasibility & Sourcing. Conduct market analysis. Initiate talks for Offtake Agreements (Supply) and secure tentative Letters of Intent (LOI) from anchor customers.

- Days 31-60: Compliance & Tech. Begin TDG/Hazmat permitting. Order long-lead items (tanks). Engage a fuel delivery app development solution provider to build your logistics platform.

- Days 61-90: Operational Readiness. Finalize insurance (MCS-90). Hiring & safety training. Launch a 90-day pilot with your first customer using rental equipment if necessary.

Future Outlook: 2030 and Beyond

By 2030, the North American fuel mix will shift dramatically.

- Gasoline/Diesel: -25% market share.

- Hydrogen: +600% growth.

- Biofuels: +167% growth.

The alternative fuels delivery business is not just a niche; it is the future of logistics. Operators who invest in the “hard assets” (supply chains, tanks) and the “soft assets” (software, compliance) today will dominate the market of tomorrow.

Read More: See how on-demand fueling is fueling a greener logistics future — Can Fuel Delivery Apps Replace Traditional Gas Stations by 2030?

Conclusion

The alternative fuels delivery business is quickly becoming a core pillar of North America’s energy transition. With hydrogen fuel delivery and biofuels distribution gaining momentum, success now depends on early preparation, securing supply, navigating regulations, and building the right digital and operational infrastructure.

Businesses that invest today in compliant technology, smart logistics, and scalable platforms will not only unlock new revenue streams but also position themselves as long-term partners in a cleaner, future-ready fuel ecosystem.

Frequently Asked Questions:-

Q1: How much does it cost to start an alternative fuels delivery business?

Initial investment ranges from $230,000 to $1.5 million for biofuels distribution and $1.3 million to $5.8 million for hydrogen delivery. Biofuels offer faster ROI (14-22 months), while hydrogen requires higher capital but offers premium margins. Government incentives can offset 20-40% of infrastructure costs in both Canada and the United States.

Q2: What licenses and permits are required for hydrogen fuel delivery in Canada?

Hydrogen fuel delivery in Canada requires Transportation of Dangerous Goods (TDG) registration, pressure vessel certifications under CSA B51 standards, provincial fuel dealer licenses, fire marshal approvals, and environmental assessment approvals. The complete permitting process typically takes 8-15 months.

Q3: Which alternative fuel should I start with—hydrogen or biofuels?

Start with biofuels for most businesses. Biofuels offer lower investment requirements, faster time-to-market (3-6 months vs. 18-24 months), proven customer demand, and leverage existing infrastructure. A phased approach—biofuels in Year 1, hydrogen planning in Year 2, hydrogen launch in Year 3—minimizes risk.

Q4: What safety training is required for hydrogen delivery personnel?

Hydrogen delivery personnel require Transportation of Dangerous Goods (TDG) certification in Canada or Hazmat endorsement in the US, hydrogen-specific safety training, emergency response training, pressure vessel handling certification, and first aid. Training typically takes 40-80 hours with annual refresher courses mandatory.

Q5: Can I retrofit my existing fuel delivery trucks for hydrogen transport?

No, hydrogen requires specialized transport equipment. Hydrogen is transported as compressed gas (350-700 bar pressure) in tube trailers or as cryogenic liquid (-253°C) in vacuum-insulated tankers. Tube trailers cost $300,000-$600,000. For biofuels, trucks can be retrofitted for $5,000-$40,000 depending on fuel type.